In the context of the rapid development of the global economy by the end of 2023, Vietnam has developed as a result of a growth process and a plan for innovation with clear perspectives. Through that, the indices belonging to the investment of this country are constantly increasing rapidly. Along with the key development goal of expanding the economy, Vietnam proves its progress in the high-tech manufacturing industry – a field that not only distinguishes countries in the ASEAN region but also marks it as a beacon of unique investment opportunities. With its consistent reforms and expanding market potential, many global enterprises are beginning to establish their businesses in Vietnam to take advantage of this growth momentum.

Backed by strong trade ties with global powers such as the U.S. and China, and driven by forward-thinking economic reforms, Vietnam is creating a story of remarkable progress and potential. Here, we explore how this dynamic Southeast Asian country is reshaping its economic destiny through each small province, becoming an increasingly important player on the world scene.

Website – Vietnam’s Unique Investment Opportunities Highlighted

Vietnam’s economy is rapidly growing, surpassing its ASEAN counterparts, with high-tech manufacturing playing a key role. This sector, along with natural resources, is significantly boosting the country’s economic profile, supported by strong trade relationships with major economies like the US and China. The growth in high-tech manufacturing is a primary factor in Vietnam’s expanding economy, offering unique investment opportunities.

Economic reforms in Vietnam have led to increased exports and domestic demand, integrating the country more deeply into the global economy. The focus on high-tech sectors has positioned Vietnam as a dynamic market with robust growth potential. This economic diversification, emphasizing high-tech industries, presents Vietnam as an attractive investment destination in emerging markets, with a strong domestic consumer base and a public equity market heavily weighted towards sectors like financials, real estate, and consumer staples.

Read More: Why Should Foreign Investors Consider Doing Business in Vietnam?

VAT Agreement Boosts Consumer Spending

The National Assembly of Vietnam has extended a 2% VAT (Value-Added Tax) reduction until June 2024 for goods and services previously taxed at 10%. This decision, aimed at stimulating consumption and production, follows previous VAT reductions implemented since 2022. The VAT cut excludes certain sectors like telecoms, IT, and real estate. The government’s VAT reduction from July to October provided US$658.2 million in financial support, boosting business activities and employment.

The policy has contributed to economic growth, with quarterly increases of 3.28%, 4.05%, and 5.33% in the first three quarters of 2023. Retail and consumption service revenue rose significantly from July to November, with a 9.6% increase in the first 11 months of 2023. The total export turnover in the first 11 months was estimated at US$291.28 billion, a 7.1% decrease, while imports decreased by 12.3%.

Read Related: 2024 Guide to VAT Incentives in Vietnam for Foreign Companies

Dong Thap Seeks Japanese Investment Partnerships

A conference in Dong Thap, Vietnam, aimed at boosting investment and trade with Japan, attracted over 50 enterprises and investors. Dong Thap’s strong trade agreements with Japan and its consistent high ranking in Vietnam’s provincial competitiveness index make it an ideal investment environment for Japanese businesses.

The total trade turnover between Dong Thap and Japan was US$18.17 million in 2022 and exceeded US$20.5 million in the first eight months of 2023. The conference highlighted Dong Thap’s potential in sectors like agricultural processing, logistics, and tourism, and discussed investment opportunities in its industrial parks and economic zones.

Read More: Choosing Ideal Business Location in Vietnam: The First Step of Success

Steady Increase in FDI for Ba Ria-Vung Tau

In the first 10 months of 2023, Ba Ria-Vung Tau attracted 20 foreign-led projects with a total registered capital exceeding US$751 million, marking a 2.78-fold increase from the previous year. Notably, Hyosung Vietnam Co., Ltd. was approved to invest US$540 million in a carbon fibre plant in Phu My 2 Industrial Park, with $120 million allocated for the first phase. This plant, the first of its kind in Vietnam, is expected to produce 4,800 tons per year in its initial phase and start operations in February 2025.

Ba Ria-Vung Tau now hosts 457 foreign projects with a combined capital of over US$31.4 billion. Of these, 284 projects are in local industrial parks, totaling US$13.7 billion, and 173 outside, amounting to approximately US$17.7 billion. The province’s efforts in administrative reform and infrastructure development, including key transport projects, have made it an attractive destination for foreign investment. The local government’s commitment to supporting businesses and resolving investment challenges further enhances its appeal to both domestic and international investors.

Read Related: Vietnam’s FDI – Analysis of Industries and Geographical Regions

CapitaLand’s Binh Duong Project Acquisition Approved

Binh Duong People’s Committee has approved Becamex IDC’s transfer of an 18.9ha urban area project in Thu Dau Mot to CapitaLand’s subsidiary, Sycamore Co., Ltd. The transfer must be completed by December 30. CapitaLand plans to invest approximately US$1.12 billion (US$796.9 million) in the project, which includes over 460 villas and about 3,300 apartments, covering a total construction area of around 593,000 sq.m.

The project, CapitaLand’s first large-scale residential development in Vietnam, is strategically located in Binh Duong New City, close to key infrastructures like the Administrative Centre Building of Binh Duong province and the My Phuoc-Tan Van Expressway. This development is expected to meet the growing demand for high-quality housing in the rapidly urbanizing area.

Read More: 7 Key Insights about Property for Foreign Investors in Vietnam

DHL Express Launches New Hanoi Gateway

DHL Express has invested in a new facility in Hanoi to support Vietnam’s growing trade, reflecting optimism in the country’s economic resilience. Vietnam’s exports and imports totaled US$557.95 billion, with a trade surplus of US$24.61 billion, a 157% increase year-on-year. Foreign-led projects in Vietnam generated US$28.85 billion in the first 11 months of 2023, up 14.8% from the previous year.

The new DHL Hanoi Gateway, double the size of the old site, boasts a 4,500 square meter space and a fourfold increase in peak handling capacity. It’s part of DHL’s extensive network, including another gateway in Ho Chi Minh City and 25 dedicated flights per week. This expansion enhances Vietnam’s connectivity with global markets and supports local businesses in accessing international opportunities.

Read Related: Business Opportunities in E-Logistics in Vietnam

Idec Group’s US$55M Bac Ninh Industrial Park

Idec Group Asia Vietnam has initiated the construction of a significant US$55 million industrial and logistics park in Bac Ninh. Covering a vast area of 12 hectares, Horizon Park is set to provide a substantial 70,000 sq.m of industrial space. This development includes 26 storage units, catering to a variety of industrial needs and demands.

Aiming for LEED Gold certification, Horizon Park integrates a photovoltaic installation to enhance energy efficiency. Its strategic location, just 35km from Hanoi, offers convenient access to major transportation hubs, solidifying Bac Ninh’s status as a pivotal industrial center. Meanwhile, VSIP Quang Ngai has made notable progress, awarding investment certificates to four new projects and two expansions, amounting to a total investment of US$80.1 million. This park’s success is evident in its attraction of over US$1 billion in capital, contributing to the creation of 30,000 jobs.

Read More: Vietnam’s Industrial Zones – A Key Player in Global Manufacturing

Exploring Trade Agreements with Turkey, UAE

During a visit to Turkey, Vietnamese Prime Minister Pham Minh Chinh discussed initiating negotiations for a Vietnam-Turkey Free Trade Agreement and proposed Turkey’s recognition of Vietnam as a market economy. The two countries, with diplomatic ties since 1978, saw a trade volume of over US$2 billion in the previous year, a 26.3% increase, and nearly US$1.9 billion in the first 10 months of this year. Turkey has 36 valid projects in Vietnam, totaling US$974.3 billion in registered capital.

In the UAE, PM Chinh attended COP28 and met with leaders to discuss expanding trade and investment. The UAE, Vietnam’s largest Middle Eastern trade partner, had a bilateral trade turnover of approximately US$5 billion in recent years, reaching nearly US$4 billion in the first 10 months of this year, a 1.8% increase. The two countries aim to increase this to US$10 billion. The UAE has 39 projects in Vietnam with a registered capital of US$71.5 million. Both countries are preparing to negotiate a comprehensive economic partnership agreement to boost cooperation in various sectors, including oil and gas.

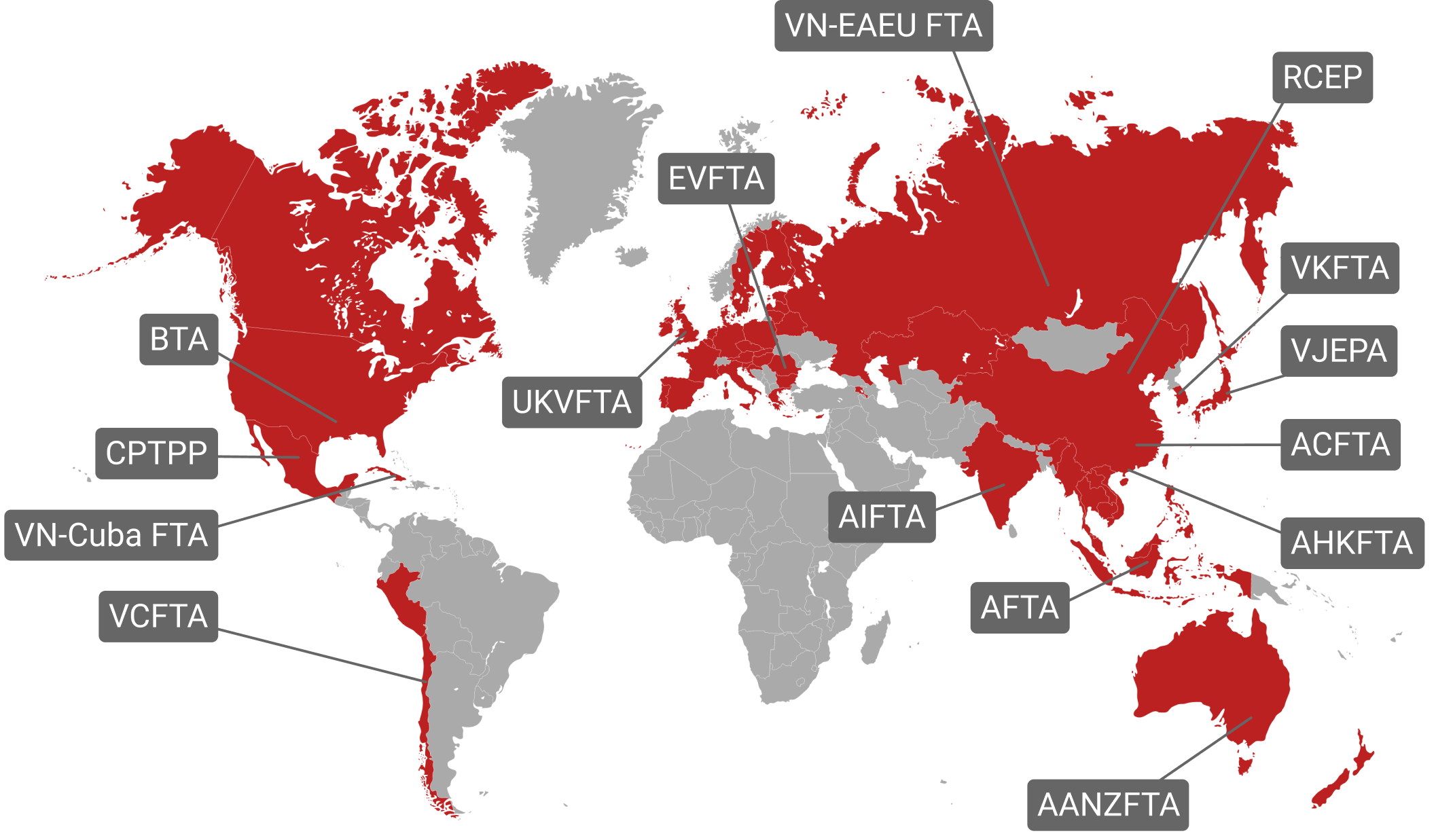

Read Related: Vietnam’s 16 Active Free Trade Agreements (Updated August 2023)

Conclusion

As 2023 draws to a close, Vietnam’s economic landscape reflects a nation on the rise, driven by a clear vision for growth and innovation. The country’s investment indices are rapidly climbing, signaling a robust economic environment. Central to this growth is Vietnam’s high-tech manufacturing sector, distinguishing the nation within ASEAN and positioning it as a hub for unique investment opportunities. These developments are underpinned by strong global trade relationships, particularly with the US and China, and are a testament to Vietnam’s dynamic economic reforms and increasing global integration.

In the realm of foreign investment, Vietnam continues to make significant strides. The country’s diverse economic sectors, from high-tech industries to natural resources, are attracting substantial capital inflows and creating numerous job opportunities. This economic dynamism is further evidenced by proactive initiatives like the VAT reduction, aimed at stimulating domestic consumption and production, and strategic partnerships seeking to bolster trade and investment with countries like Turkey and the UAE. As Vietnam continues to evolve and expand its economic footprint, it solidifies its position as a key player in the global market, offering a wealth of opportunities for investors and businesses alike.

Investing in Vietnam? Check out InCorp Vietnam’s Incorporation Services for Investors

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

How to make $1000 a month by investing?

- To make $1,000 a month from investing, you need to generate $12,000 annually in returns. Assuming an average annual return of 6%, you would need to invest approximately $200,000 ($12,000 ÷ 0.06). The exact amount depends on the type of investment (e.g., dividends, rental income, interest) and associated risks. Diversifying across income-generating assets like stocks, bonds, or real estate can help achieve this income target.

What is the best investment in Vietnam?

- The best investment in Vietnam depends on the investor's goals, but high-potential sectors include manufacturing (especially electronics and textiles), real estate, renewable energy, and information technology. The country’s young workforce, growing middle class, and integration into global trade agreements make it particularly attractive for foreign direct investment (FDI) in export-oriented production and infrastructure development.