Vietnam’s February 2025 highlights the country’s strong foreign direct investment (FDI) momentum, with new economic zones, strategic infrastructure projects, and high-tech developments reshaping the business landscape. With US$4.33 billion in FDI recorded in January alone, regions like Northern Vietnam, gateway to Central Vietnam, Da Nang, Dong Nai, and Quang Tri are emerging as top destinations for global investors.

This blog provides an in-depth analysis of the latest investment trends, highlighting high-value projects and emerging business opportunities across Vietnam’s rapidly growing economic landscape. It explores key industries driving foreign direct investment, including manufacturing industry, logistics, renewable energy, and semiconductors, and examines how government policies, infrastructure developments, and investment incentives are shaping Vietnam into a premier destination for global investors and businesses seeking expansion.

Interested in Investing in Vietnam? Check out InCorp Vietnam’s Incorporation Services

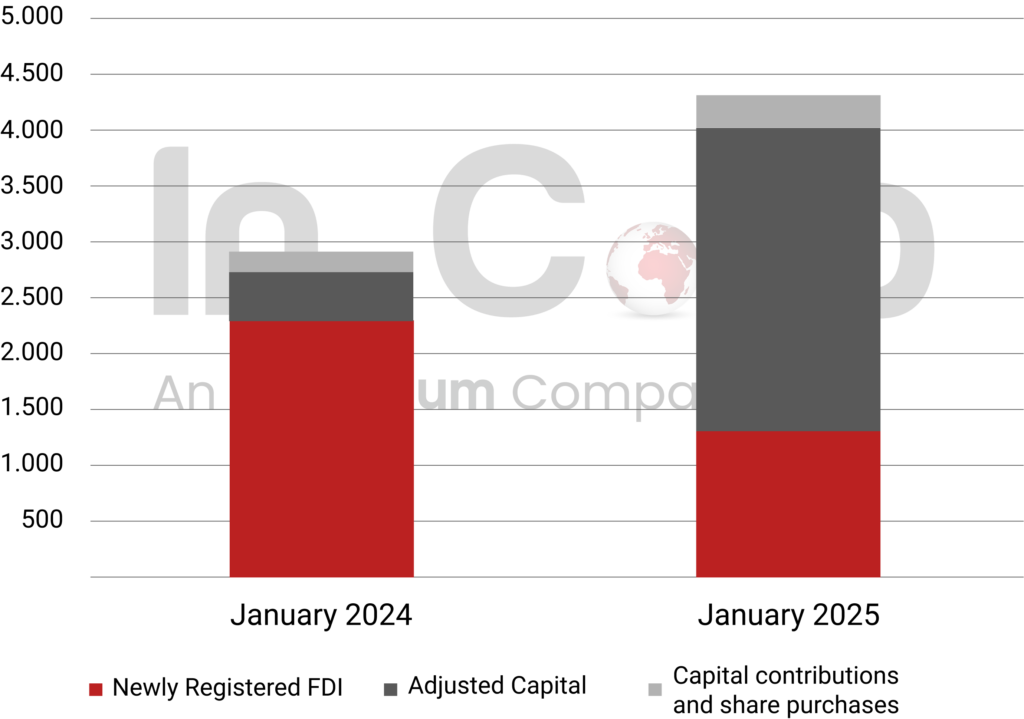

Vietnam’s FDI Hits US$4.33B in January 2025

Vietnam attracted US$4.33 billion in foreign direct investment (FDI) in January 2025, up 48.6% year-on-year. Newly registered capital declined 43.6% to US$1.29 billion, while adjusted capital for 137 projects surged sixfold to US$2.73 billion. Capital contributions and share purchases hit US$323 million, up 70.4%. The manufacturing sector led with US$3.09 billion, while real estate followed with US$1.09 billion.

South Korea topped investors with US$1.25 billion, followed by Singapore at US$1.24 billion. Bac Ninh province led FDI destinations, securing US$1.39 billion, a sixfold increase, followed by Dong Nai (US$959 million) and Capital of Vietnam (Hanoi) (US$716.4 million). 39 cities and provinces received FDI inflows, highlighting Vietnam’s strong investment appeal despite a drop in new project registrations.

Read More: Vietnam FDI: Analysis of Industries, Source Countries, and Geographical Regions

Japan – Vietnam Strengthen Semiconductor Industry Ties

Kyushu, Japan’s semiconductor hub, is investing US$30 billion in over 100 projects, including a billion-dollar TSMC chip factory. With Japan needing 200,000 semiconductor engineers, Vietnam is key to workforce development. FPT Semiconductor aims to train 50,000 engineers by 2030, launching co-innovation spaces, microchip programs, and recruiting 1,000 students in the first year.

Japan plans US$10 billion in semiconductor investments by 2025, increasing to US$330 billion over 10 years. Vietnam’s National Innovation Center is fostering R&D partnerships, while Renesas’ 1,500-strong R&D team highlights Vietnam’s potential. The collaboration will drive chip production, AI integration, and technology transfer, positioning Vietnam as a key semiconductor player in Japan’s global strategy.

Read More: Understand the Fundamentals of Vietnam – Japan Trade Under the VJEPA

European Investment in Vietnam Reaches US$1.5 Billion

Vietnam attracted US$1.5 billion in EU investment in 2024, making up 3.92% of total foreign funding. The EuroCham Business Confidence Index surged from 46.3 to 61.8, with 56% of firms optimistic about economic stability. 47% anticipate a strong business outlook in early 2025, driven by export growth, infrastructure investment, and administrative reforms enhancing Vietnam’s investment climate.

Luxembourg ranks third among EU investors, with US$400 million across 31 projects in the city of Ho Chi Minh. Meanwhile, German firms focus on local sourcing, R&D, and manufacturing to strengthen supply chains. Vietnam’s digital economy is booming, with investments in fintech, AI-powered logistics, and edtech, positioning the country as a key hub for European investors expanding in Asia-Pacific markets.

Read More: 9 Ways Ho Chi Minh City Supports New Business Growth

Vietnam Expands Semiconductor Ties with South Korea

The Vietnam Semiconductor Investment Forum in Seoul attracted 150 delegates from leading South Korean tech firms like Samsung, SK, and Hana Micron. Vietnam’s National Innovation Center (NIC) highlighted new investment incentives under Resolution No.57-NQ/TW to boost semiconductor R&D and AI industries. South Korea’s Hana Micron praised Vietnam’s low-cost, high-quality workforce and pro-business policies.

Vietnam aims to become a global semiconductor hub, prioritizing design, personnel, and post-audit services. The NIC plans investment promotion events in 2025, leveraging government-backed financial incentives covering up to 50% of semiconductor and AI project costs. Vietnam’s growing high-tech ecosystem is positioning it as a key player in South Korea’s global supply chain expansion.

Read More: Unlocking Opportunities and Overcoming Challenges in the Global Semiconductor Industry

Northern Vietnam Expands Economic Zones with FDI

Northern Vietnam approved new economic zones (EZs), including Ninh Co EZ (14,000 hectares) and Southern Haiphong Coastal EZ (20,000 hectares). Thai Binh EZ attracted US$3.74 billion in FDI from 2021-2023, with key projects like US$212 million VSIP Thai Binh, US$200 million Pegavision Vietnam, and a US$100 million soju plant, ranking 5th in FDI in 2023.

A US$2 billion LNG thermal power plant with 1,500MW capacity is under development by a Japanese-Vietnamese consortium. In 2024, Thai Binh EZ secured over US$1 billion in foreign investment. Local governments seek tax incentives and relaxed land-use policies, while Hai Duong plans to increase personal income tax exemptions by 150% for R&D professionals to attract high-tech investment.

Read Related: Choosing Where to Set Up a Business in Vietnam

Danang Advances with Free Trade Zone

Danang is set to become Vietnam’s first Free Trade Zone (FTZ), covering 2,350 hectares across 10 locations linked to Lien Chieu Seaport and Danang International Airport. Phase 1 (until 2029) includes US$1.5 billion in investment, with US$865 million for site clearance and US$630 million for infrastructure. Ships up to 100,000 deadweight tonnage will be accommodated, with site clearance finishing by 2027.

The FTZ aims to position Danang as an international trade hub, supported by Lien Chieu Seaport, Danang Airport, and a regional financial center. The government’s Resolution 136 offers tax, land, and cost incentives to attract investment. The project is expected to increase FDI, boost logistics and tourism, and expand high-value trade services, making Danang a rising economic powerhouse in Southeast Asia.

Dong Nai Secures Investment Across Sectors

Dong Nai approved US$738 million in investments for eight new projects and six capital adjustments. Foreign investors contributed US$243 million, while a domestic project added US$35 million. Singapore’s Mapletree Logistics Park Tam An 1 leads with US$101.1 million, followed by Quest Composite Technology (US$39.9 million) and Mega Lifesciences (US$28 million) for pharmaceuticals and medical equipment production.

Japan’s SMC Manufacturing Vietnam is expanding with US$330 million, bringing its total investment in Dong Nai to US$1 billion, the largest Japanese project in the province. South Korea’s Hyosung increased investment by US$19.7 million to US$976.34 million, while Taiwan’s Advanced Multitech added US$12 million to expand its golf club factory.

Quang Tri Secures US$6.78B Across 200 Projects

Quang Tri’s economic and industrial zones have attracted nearly 200 projects with a total registered capital exceeding US$6.78 billion across 5,978 hectares. These zones generate US$410 million in annual revenue, contribute US$20.5 million to the state budget, and provide 6,700 jobs with an average monthly income of US$270. Three new industrial parks are set to launch by Q2 2025.

The 2.1 trillion VND (US$86 million) Quang Tri Industrial Park began construction in December 2023 and will create 30,000–40,000 jobs. The US$184 million Trieu Phu IP will start in Q1 2025, focusing on agriculture and construction materials, while the US$37 million Northwest Ho Xa IP will specialize in wood processing, solar energy, and seafood. Expansion plans include a 2,300-hectare upgrade to the Southeast Economic Zone.

Conclusion

With Vietnam’s expanding economic zones, pro-business policies, and increasing FDI inflows, the country is solidifying its position as a regional hub for global investments. New infrastructure developments, tax incentives, and regulatory reforms are creating favorable conditions for businesses across diverse sectors, from manufacturing and high-tech industries to logistics and renewable energy. This rapid transformation presents a wealth of opportunities for companies looking to establish or scale their operations in Vietnam.

Businesses seeking to expand or enter Vietnam’s thriving market can benefit from InCorp Vietnam’s industry expertise and tailored corporate solutions. With a deep understanding of market entry strategies, compliance regulations, and corporate structuring, InCorp Vietnam provides businesses with the strategic guidance and operational support needed to navigate Vietnam’s evolving investment landscape and achieve long-term success.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly