Vietnam’s Food & Beverage (F&B) sector, integral to the nation’s consumer market, is currently experiencing a period of significant transformation. Post-pandemic, this sector is not only recovering but also rapidly adapting to new market trends and consumer behaviors. Many entrepreneurs looking to tap into this fast-growing sector are also setting up formal business entities through company setup services to simplify licensing and operational compliance. Central to Vietnamese culture and social life, the food & beverage industry is more than a provider of food; it is a creator of experiences and a nurturer of community connections.

As Vietnam progresses toward recovery, the food & beverage industry is at the forefront, adapting to changing consumer preferences, technological innovations, and evolving regulations. This article explores the current trends, challenges, and investment opportunities within Vietnam’s food & beverage market. We will look at how businesses are reshaping their strategies to succeed in the new normal, with a focus on community engagement, sustainability, and innovation.

Food & Beverage Market Overview in Vietnam

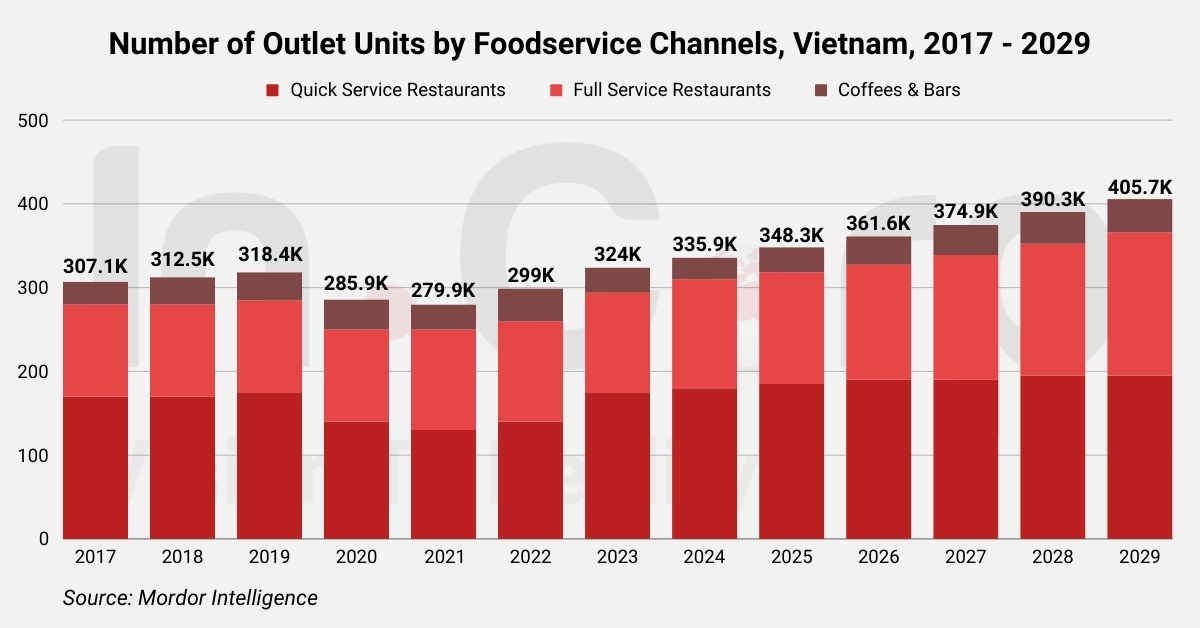

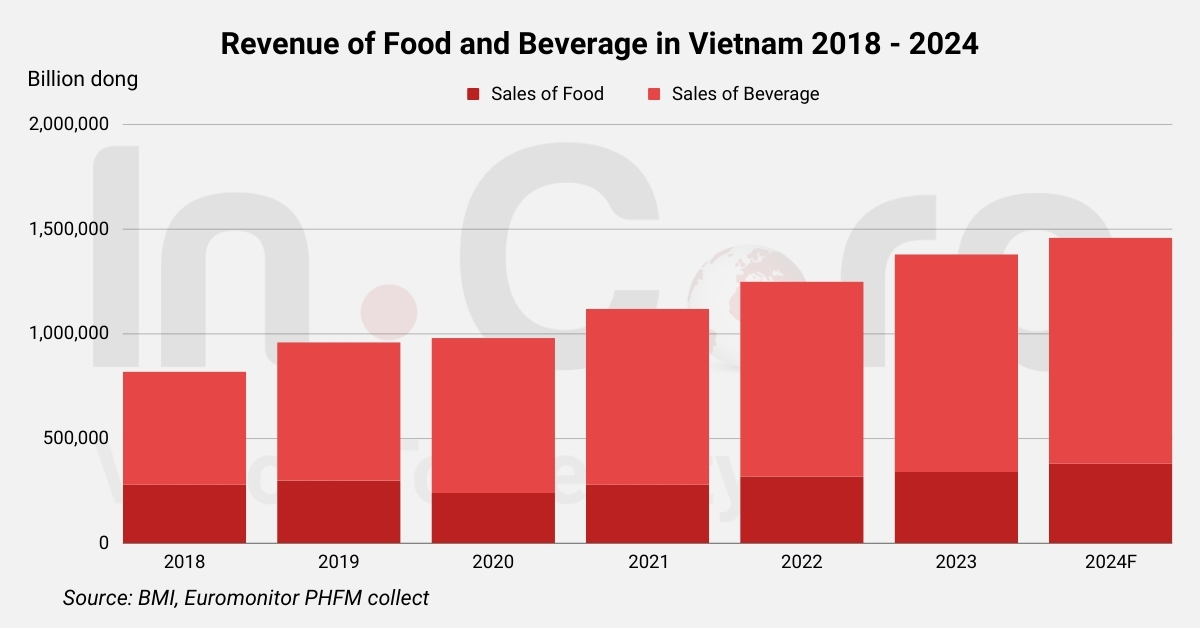

According to expert analyses, despite various economic challenges anticipated in 2025, Vietnam’s food & beverage market is set to thrive, experiencing a 9.6% revenue growth. Post-pandemic stabilization will further bolster this sector, leading it toward the remarkable milestone of nearly VND 873 trillion valuation by 2027. The market value reached approximately VND 688.8 trillion (US$27.3 billion) in 2024, representing a 16.6% increase from 2023. By the end of 2024, the number of F&B establishments in Vietnam was estimated at 323,010 stores, marking a 1.8% increase compared to the previous year.

Vietnamese consumers have clearly defined their favorite pastimes, with restaurants, cafes, and shopping malls emerging as the top contenders. In their leisure time, these five destinations receive the most visits, reflecting the lifestyle and preferences of the local population. Dining preferences in Vietnam exhibit an interesting age-based pattern. Fast food and convenience stores hold a strong appeal for the youngest demographic, those aged 18-24. On the other hand, local food establishments and pizza/pasta restaurants find favor among the 25-34 age group.

In 2025, the Vietnam Food Service Market is estimated to be valued at approximately US$24.77 billion, with a promising outlook for the forecast period from 2025 to 2030. During this period, the market is projected to experience a noteworthy Compound Annual Growth Rate (CAGR) of 10.73%, ultimately reaching an impressive US$41.22 billion by 2030.

Alternative projections suggest even stronger growth, with some reports indicating the market could reach US$54.27 billion by 2033, representing a CAGR of 9.70% during 2025-2033.

Within the food service landscape, Full Service Restaurants emerge as the dominant segment, reflecting the largest market share. This trend is expected to persist, with full-service restaurants maintaining their prominence. Notably, in 2024, nearly 70% of individuals dined out on weekends, indicating a rising trend in dining out frequency.

Among various outlet types, Independent Outlets emerge as the key contributors to the Vietnam Food Service Market. Asian full-service restaurants within this segment hold a prominent position, primarily due to the widespread utilization of seafood sauces, an integral component of numerous Asian culinary creations, such as “Canh chua cá.”

A noteworthy highlight is the impressive growth of Cloud Kitchens, which has emerged as the fastest-growing foodservice category in the Vietnam Food Service Market. The surge in internet usage, with approximately 79% of the population actively engaged online and 87% smartphone penetration, has significantly propelled the growth of cloud kitchens and online food delivery services.

Moreover, Chained Outlets represent the fastest-growing outlet category in the Vietnam Food Service Market. This growth can be attributed to the strong emphasis on consistency and standardized food quality, particularly driven by the concerns of food safety expressed by nearly 90% of the population. The dominance of Quick Service Restaurants (QSRs) within this segment underscores the importance of stringent food safety standards in the industry.

Read More: Ease of Doing Business in Vietnam: Why Do Foreign Investors Choose This Destination?

Investment Opportunities for Food & Beverage Foreign Investors

Potential from Market: Projection from Experts

Recent data shows remarkable growth in Vietnam’s food & beverage sector. According to IMARC Group, the Vietnam food service market is projected to grow from US$21.92 billion in 2024 to US$54.27 billion by 2033, marking a CAGR of 9.70% during 2025-2033. The market is driven by rapid urbanization and a rising middle class, with Vietnam’s urbanization rate expected to exceed 50% by 2030.

VNDirect, a prominent securities company, projects continued growth in the food & beverage industry in 2025, with the market expected to achieve a growth rate of 9.6%. This positive outlook is attributed to the resumption of in-person services and the recovery of domestic consumption. Moreover, market research firm BMI suggests an upward trajectory in Vietnamese households’ spending habits for the years 2022-2025.

Tourism expansion significantly supports growth, with targets of 18 million international and 130 million domestic visitors by 2025, rising to 35 million international and 160 million domestic visitors by 2030. Foreign direct investment reached over US$13.43 billion in the first half of 2023, encouraging global food chains to enter the market and introduce new dining concepts.

The average income of workers in 2024 was VND 7.7 million per month, representing an 8.6% increase compared to the previous year. The average income per capita at current prices in 2024 is estimated at around VND 5.4 million per month, an 8.8% increase compared to 2023. With economic recovery expected to continue, income is anticipated to improve further in 2025, supporting consumer spending.

Investing in Vietnam? Check out Talk to our Company Registration Consultants

The food & beverage landscape in Vietnam presents an irresistible opportunity for investors on a global scale. Vietnam stands out as a dynamic market, and with shifting consumer behaviors, increased mobility, rising affluence, and rapid urbanization, it’s poised to secure a position among the top three food & beverage development nations in Asia.

Notably, Vietnam has become a magnet for capital from countries like Korea, Germany, Singapore, and Thailand. As the digital transformation revolutionizes dining experiences, emphasizing safety and security, the demand for top-notch food & beverage products is on the rise. This translates to a plethora of untapped markets waiting for visionary newcomers to explore. By staying ahead of the curve and embracing trends with sustainability and innovation at their core, investors can unlock the immense potential of the Vietnam food & beverage market.

However, investors should approach this promising market with awareness. Striking the right balance between competitive pricing strategies and upholding stringent food safety and hygiene standards is paramount, particularly as cost pressures intensify in 2025. In the eyes of consumers, these factors are non-negotiable, and businesses that can harmonize them will reap the rewards of this thriving food & beverage industry.

Read Related: Vietnam’s Economic Growth Projections: Surpassing Southeast Asian Nations by 2036

Behaviors of Food & Beverage Customers in Vietnam

The high-income consumers of Vietnam exhibit a proclivity to elevate their spending on food & beverage, as compared to other demographics. Recent surveys reveal evolving spending patterns, with 52.3% of Vietnamese people now prioritizing spending less than VND 35,000 for each drink, showing a trend of optimizing budget when shopping. However, the habit of consuming drinks outside has grown strongly compared to 2023, with the rate of regular drinkers (3-4 times/week) increasing dramatically from 17.4% (2023) to 32.8% (2024).

Vietnamese consumers are experiencing rising levels of stress, averaging 1.98 times per week, with younger and busier demographics being the most affected. While 68% of consumers rate their mental health positively, there is increasing demand for solutions such as wellness-focused food and beverage options.

Consumers spend an average of 1.38 million VND per month on health-related products and services, with purchasing decisions primarily driven by health consciousness and convenience factors.

Trends for Vietnam’s Food & Beverage Investors in 2025

Cloud Kitchen

A cloud kitchen, often referred to as a delivery-only restaurant, is a dining concept without a physical space for in-person dining. Instead, it relies solely on online orders placed through food aggregation platforms or dedicated online ordering platforms, accessible via websites or mobile apps.

In 2025, the cloud kitchen segment is projected to be the fastest-growing in the foodservice market, with a CAGR of 3.72% during the forecast period. The average order value (AOV) for cloud kitchens reached USD 3.45 in 2022, the highest among foodservice types, indicating strong consumer spending in this segment.

One of the distinguishing features of the cloud kitchen format is its remarkable flexibility. It empowers restaurateurs to introduce multiple brands utilizing the same kitchen infrastructure. This innovation, known as multi-brand cloud kitchens, allows culinary entrepreneurs to leverage existing kitchen resources to operate a variety of distinct brands.

Vietnam’s food delivery market experienced remarkable growth, expanding 26% from US$1.4 billion in 2023 to US$1.8 billion in 2024, making it the fastest-growing food delivery market in Southeast Asia. In Vietnam, Grab holds 48% of the market share, while ShopeeFood holds 47%, together controlling 95% of Vietnam’s food delivery market.

The global cloud kitchen market is growing steadily from USD 82.01 billion in 2025 to USD 227.41 billion by 2034 at a CAGR of 12%, with Asia Pacific dominating the market. Predictions suggest cloud kitchens will occupy up to 30% of the entire F&B industry market share by 2025.

The cloud kitchen model in Vietnam is now experiencing significant development, with notable players including CloudEats, Air Kitchen, Deliany, Révi Coffee & Tea, QUỐC YẾN CLOUD KITCHEN, and Cyber Kitchen entering the market.

Healthy Eating, Vegetarianism and Veganism

Healthy Eating

Across Southeast Asia, including Vietnam, people are showing a growing interest in healthier eating, especially after the pandemic. They’re willing to spend more on food that’s good for them. This trend has sparked a demand for new kinds of foods and diets like gluten-free and keto. For companies that want to get in on this trend, it’s important to consider Vietnam’s food culture. They must think about how they can offer healthier options that are also suitable for the Vietnamese.

Healthy eating has become a significant trend in Vietnam, especially after the pandemic. The market’s largest segment is bread and cereal products, with a market volume of US$17.47 billion in 2025. However, affordability remains a concern. While healthy diets are becoming more accessible due to rising incomes, they are still unaffordable for approximately 70% of low-income households, where adherence can cost up to almost 70% of their income.

Planned diets like Paleo, Mediterranean, and vegan are becoming increasingly popular, particularly in urban areas. 79% of consumers regularly or occasionally use dietary supplements, creating significant opportunities for plant-based foods, low-carb meal solutions, and functional foods.

The Vietnamese love their green veggies which do not just include kale and spinach. They not only enjoy snacks that are good for them but also prefer sharing meals with others. But healthy eating isn’t just about the ingredients. People are paying more attention to what’s in their food and where it comes from. They want to know that the fruits and veggies they buy are safe to eat. This is especially true for traditional wet markets.

After the pandemic, more and more people are taking their health seriously. This has led to a rise in brands that offer healthier food options, especially in big cities like Hanoi, Saigon, and Da Nang.

This trend isn’t new, it’s been around for about a decade, with the pandemic being its stimulus. However, many Vietnamese still prefer traditional dishes like hotpot, grilled food, fast food, rice, and pho due to their eating habits. However, there’s a growing number of customers choosing healthier options and thus, this trend is gradually but certainly gaining ground.

Vegetarianism

Vegetarianism is no longer limited to Buddhists; it’s now an integral part of daily life in many countries, including Vietnam. People are increasingly aware of the incredible benefits of vegetarianism, which includes consuming a variety of vegetables, beans, and fruits. It’s seen as a way to maintain good health, cleanse the body and mind, and even manage weight.

But there are many other reasons why people are choosing vegetarian options or reducing their meat intake. Some simply find vegetarian food delicious and appreciate this sustainable eating style. Others do it to avoid consuming animals and protect the environment. Some turn to it when they want to pray or make amends for something.

Vegetarianism is gaining popularity in Vietnam beyond traditional Buddhist practices. In 2021, 87% of Vietnamese consumers had tried plant milk, 46% had tried other dairy alternatives, 49% had tried plant-based meat, and 32% had tried vegan egg substitutes. Health was the primary motivation for 61% of respondents, followed by concern for animals (40%) and the desire to try a food trend.

Restaurants are responding to this trend by offering extensive vegetarian menus, with some buffets boasting nearly a hundred different vegetarian offerings. These dishes come in various culinary styles, including pure Vietnamese, Thai, Indian, and European vegetarian cuisine, showcasing the global appeal of plant-based dining.

The trend of vegetarianism, especially on full moon days, is on the rise. It’s not uncommon to see restaurants serving vegetarian dishes or offering vegetarian buffets bustling with customers these days. Some foreigners living in Vietnam even humorously suggest using the lunar calendar on their phones to plan when to dine out because vegetarian restaurants are so packed on these occasions.

What’s driving this trend is not only the health benefits but also the delightful preparation and presentation of vegetarian dishes. They’re not only delicious but also affordable, often costing just half or even a third of a meat-based meal. This combination of taste, aesthetics, and value is attracting more and more people to savor vegetarian options even on regular weekdays.

In terms of quantity, restaurants often feature extensive vegetarian menus with as many as 30 to 50 dishes. It’s not uncommon to find buffets boasting nearly a hundred different vegetarian offerings. They come in various culinary styles, including pure Vietnamese, Thai, Indian, and European vegetarian cuisine, showcasing the global appeal of plant-based dining.

Veganism

Veganism is not merely a dietary choice but a comprehensive philosophy and way of life. Its fundamental principle is to minimize, to the greatest extent possible and practical, all forms of animal cruelty or exploitation, whether for clothing, food, or any other purpose. This ethos extends beyond the welfare of animals and encompasses the well-being of humans and the environment. In practical terms, veganism entails a commitment to abstain from all products that are entirely or partially derived from animals.

Veganism in Vietnam is experiencing significant growth, driven by concerns about animal welfare, environmental sustainability, and health and wellness. The vegan food market in Vietnam is projected to exhibit a growth rate (CAGR) of 8.1% from 2025 to 2033, reaching USD 220.5 million by 2033 from USD 103.2 million in 2024.

This growth is supported by the increasing availability of nutritious and delicious vegan alternatives, advancements in food technology, and the development of innovative plant-based substitutes that closely mimic the taste and texture of animal products. These innovations make the transition to a vegan diet more accessible and appealing to a broader audience.

In 2021, 10% of Vietnamese respondents reported that they only consume plant-based foods, indicating a significant shift towards veganism in the country.

Veganism continues to surge in popularity, fueled by a growing interest in healthier lifestyles. The trend towards meat-free and dairy-free diets has gained momentum, with endorsements from celebrities, and renowned chefs, and a surge in vegan products at supermarkets.

Sustainability and Quality of Organic Food

Vietnam’s food and beverage industry is experiencing a significant shift towards organic foods, driven by rising disposable incomes, a burgeoning middle class, and a younger generation keen on diverse food options. The organic food market in Vietnam was valued at USD 1.2 billion in 2024 and is expected to reach USD 3.0 billion by 2033, exhibiting a growth rate (CAGR) of 9.9% during 2025-2033.

This transformation is further fueled by government initiatives promoting food safety and a clean food chain. As of the end of 2023, Vietnam had 495,000 hectares of organic agricultural production, accounting for 4.3% of the country’s total agricultural production area . The government aims to increase this to 2.5–3% of the total agricultural land area by 2030.

Consumer awareness is also on the rise. A 2023 survey by AC Nielsen revealed that 86% of Vietnamese consumers prioritize organic options for their daily meals due to their nutritional value, safety, and minimal environmental impact. Additionally, 24% of respondents consume organic food daily, with another 16% and 21% consuming organic products four to five times a week and two to three times a week, respectively.

Vietnamese consumers are willing to pay a premium for organic products. Recent surveys revealed that 45% would spend up to 25% more on organic versus conventional foods, while 6% had no spending limit. Organic vegetables from specific suppliers consistently sell out despite costing 25-35% more than regular produce.

Government initiatives promoting food safety and a clean food chain further fuel the demand for organic products. Consumers are growing more conscious of how their environment affects the quality of their food. This heightened environmental awareness is compelling food & beverage establishments to prioritize sustainability. Restaurants are revamping their branding, adopting sustainable sourcing practices for raw materials, and reevaluating their packaging choices. Manufacturers are grappling with similar challenges, focusing on promoting the health benefits of their products in response to the evolving consumer landscape.

Moreover, Vietnam’s rich soil and diverse climate provide an ideal environment for cultivating a wide range of organic produce. As health-consciousness sweeps across the nation, the demand for organic and wholesome food is surging. This appetite for healthier options extends beyond locals to expatriates residing in Vietnam and tourists seeking authentic and nutritious dining experiences.

International enterprises can capitalize on this burgeoning trend by investing in organic farming, the processing of organic goods, and their distribution in Vietnam. By delivering top-tier organic food products free from harmful chemicals, businesses can set themselves apart from competitors and capture the loyalty of health-conscious consumers.

Moreover, the Vietnamese government is proactively fostering the growth of the organic food sector. They offer incentives and support to businesses within this industry, such as tax incentives, low-interest loans, and aid in obtaining product certifications.

Online Food Deliveries

Having a Presence with Online Delivery

Vietnam’s government is spearheading a digital revolution, and the food & beverage sector is fully embracing the change. The year 2024 witnessed a substantial uptick in restaurants adopting digital solutions, with technology now playing a pivotal role across various aspects of operations including customer service, human resource management, purchase value tracking, and data-driven decision making.

Recent data from IMARC Group reveals that Vietnam’s online food delivery market was valued at USD 968.14 million in 2024, with projections to reach USD 3,221.43 million by 2033, exhibiting a CAGR of 13.58% during 2025-2033. Alternative projections suggest the market will reach US$2.79 billion in 2025, with expected annual growth of 9.34% (CAGR 2025-2030), resulting in a projected market volume of US$4.36 billion by 2030.

Vietnam’s food delivery market experienced remarkable 26% growth in 2024, expanding from US$1.4 billion in 2023 to US$1.8 billion, making it the fastest-growing food delivery market in Southeast Asia.

Online food delivery platforms bring a world of convenience to the table. They promise effortless ordering, swift deliveries, reduced order mix-ups, and minimal face-to-face interactions. Additionally, enticing discounts and cashback offers have endeared these services to the younger demographic, catapulting them to widespread popularity throughout Vietnam. Among the standout players in this arena are GrabFood (48% market share), ShopeeFood (47% market share), BeFood (4% market share), with Gojek’s GoFood exiting the Vietnamese market in September 2024.

Non-Presence and Only Online Delivery

Following the digital transformation accelerated by the pandemic, Vietnamese consumers have increasingly embraced online food ordering and delivery services. Major platforms like Grab, ShopeeFood, Baemin, and delivery services from e-commerce giants such as Shopee, Lazada, Tiki, and Sendo, alongside major supermarket chains, have established comprehensive door-to-door delivery networks.

For small businesses, this shift marked a financial reprieve, as maintaining physical stores became less burdensome. Small and medium-sized enterprises (SMEs) shifted their focus to expanding promotions, enhancing customer service, and streamlining logistics to bolster revenue. The wealth of data available through online business models enabled companies to personalize offerings in areas like diet, nutrition, and fitness, aligning with the burgeoning trend toward healthy eating.

This change also democratized market entry, making it accessible to virtually anyone capable of setting up an online store. Big brands, too, capitalized on this shift, using e-commerce channels to sell directly to consumers (D2C) through platforms like ShopeeMall and LazMall. These official stores provided enhanced credibility compared to resellers, attracting a larger customer base. Manufacturers and consumer brands no longer rely solely on traditional distribution channels. They now connect directly with their customers through online marketing campaigns, offering more precise feedback, expanded sales, and less time spent negotiating with distributors and intermediaries.

In Vietnam’s dynamic food & beverage market, selling food online has become the norm. However, a significant challenge arises from the high commissions charged by online food ordering platforms, typically ranging from 20% to 25% per order. This substantial cost eats into profits and forces restaurants to rethink their strategies.

Intense competition on food ordering apps, with brands engaging in a relentless “discount race” to secure orders, further threatens profitability. As a result, food & beverage businesses are increasingly seeking balance by diversifying their order sources. They are aiming for an optimal ratio, often around 8/2, meaning 80% of orders come from applications while 20% originate from self-operated systems via hotlines and inboxes. These establishments are also exploring self-delivery options through services like AhaMove and GrabExpress. In the future, this ratio may shift even more in favor of self-operated systems as businesses navigate the evolving landscape of online food sales.

Challenges in Vietnam’s Food & Beverage Industry

While the food & beverage sector in Vietnam offers enticing investment opportunities, it is not without its share of challenges in 2025. A recent report highlights several obstacles that businesses face during their recovery and development journeys, with human resources being a prominent concern for 99.1% of surveyed enterprises.

The most critical challenge facing the industry is cost pressure. Over 60% of the more than 4,000 F&B businesses surveyed reported revenue decreases, and even businesses with stable or increased revenue acknowledged relatively thin profit margins due to rising costs. Nearly 45% of businesses stated that raw material costs account for 30% or more of their selling price, with 6.2% even exceeding 50%, pushing profit margins into dangerous territory.

The primary HR challenges are listed down below:

- Many businesses struggle to find qualified personnel and they also face difficulties in retaining them. The lack of professional staff and high labor costs compound this issue.

- Employees in the food & beverage market often need to fulfill multiple roles, which can be demanding and lead to burnout. Clear investment opportunities for career advancement are also lacking.

- Employers tend to offer limited benefits such as social insurance and bonuses like the 13th-month salary, making positions in the industry less attractive.

Moreover, around 16.3% of businesses grapple with work scheduling difficulties, while 10.4% encounter problems in accurately calculating staff salaries. Most businesses still rely on traditional methods for shift management, using tools like Excel, Zalo, or fingerprint attendance machines.

Additional cost pressures in 2025 include rising real estate rental costs due to increased property values, with many landlords raising rents to reflect property values. Transportation expenses are increasing due to political instability and fluctuating fuel prices. Tax policies and import regulations are also being tightened, coupled with climate change affecting agricultural supply, leading to reduced yields of coffee, sugar, rice, and vegetables.

Competition is becoming increasingly intensified, with the market becoming more polarized. Advantages favor brands that have well-structured business strategies and long-term development plans. Nearly 60% of F&B companies witnessed revenue declines in 2024, despite overall market growth.

To counter rising costs, 49.2% of F&B businesses plan price increases in 2025. However, businesses with six or more outlets show greater willingness to increase prices (over 53%) compared to single-outlet businesses (50.25%), indicating that larger chains have more control over pricing strategies.

However, approximately 94.7% of these enterprises have recognized their weaknesses and taken steps to modify their production structures. Furthermore, 68.4% of them have adopted modern technology in their production and distribution processes. This strategic move not only creates a competitive edge but also enhances the overall customer shopping experience, especially in times of crisis.

Read More: Top 10 Challenges of Doing Business in Vietnam: Notes and Advice for Foreign Investors

Conclusion

Vietnam’s food & beverage industry is undergoing a significant transformation, driven by shifting consumer preferences, a growing middle class, and digitalization. The food & beverage market in Vietnam is poised for substantial growth, with experts projecting a promising future.

However, the industry faces its share of challenges. Competition is intense, both domestically and internationally. Navigating the dynamic export market, with its changing quality requirements and complex FTAs, poses another set of challenges.

Despite these obstacles, Vietnam’s food & beverage industry offers substantial promise. As consumers seek healthier, more sustainable options, businesses that can adapt, innovate, and embrace modern technology are well-positioned for success in this dynamic and evolving market. With government support and a growing appetite for diverse culinary experiences, the Vietnamese food & beverage industry is on a path of exciting growth and transformation.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly