As Vietnamese consumer preferences evolve, there is a notable trend toward the adoption of Western culinary and beverage choices, with wine standing out prominently. The wine sector in Vietnam has experienced remarkable growth, presenting a varied array of offerings such as red, white, sparkling wines, and spirits. Nonetheless, the intricacies involved in importing wine into the Vietnamese market pose significant challenges, particularly for businesses not well-versed in the requisite procedures.

Importing wine into Vietnam requires specialized sub-licenses and detailed management from initial licensing to post-distribution inspections. Businesses must navigate complex customs regulations and meticulously plan to secure the necessary permits. Enterprises must develop a strategic approach and accurately estimate the time needed to complete these legal procedures.

Interested in the Market of Wine in Vietnam? Check out InCorp Vietnam’s Incorporation Services

The Market of Wine in Vietnam

Vietnam’s robust economic growth is significantly supported by its dynamic food and beverage sector, which expanded with a compound annual growth rate (CAGR) of 11.3% from 2017 to 2021. The wine segment has notably thrived, with imports growing annually by 10% since 2010.

In Vietnam, wines are primarily categorized by their country of origin, with top preferences being France, the USA, Chile, Italy, and Australia. French wines lead the market with a 35% share, closely followed by Chile at 25%.

The country presents lucrative opportunities for wine exporters, especially from Australia and Europe, thanks to favorable trade agreements like the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA), which reduces tariffs and enhances trade conditions.

Read Related: Definitive Guide to Vietnam’s 16 Active Free Trade Agreements

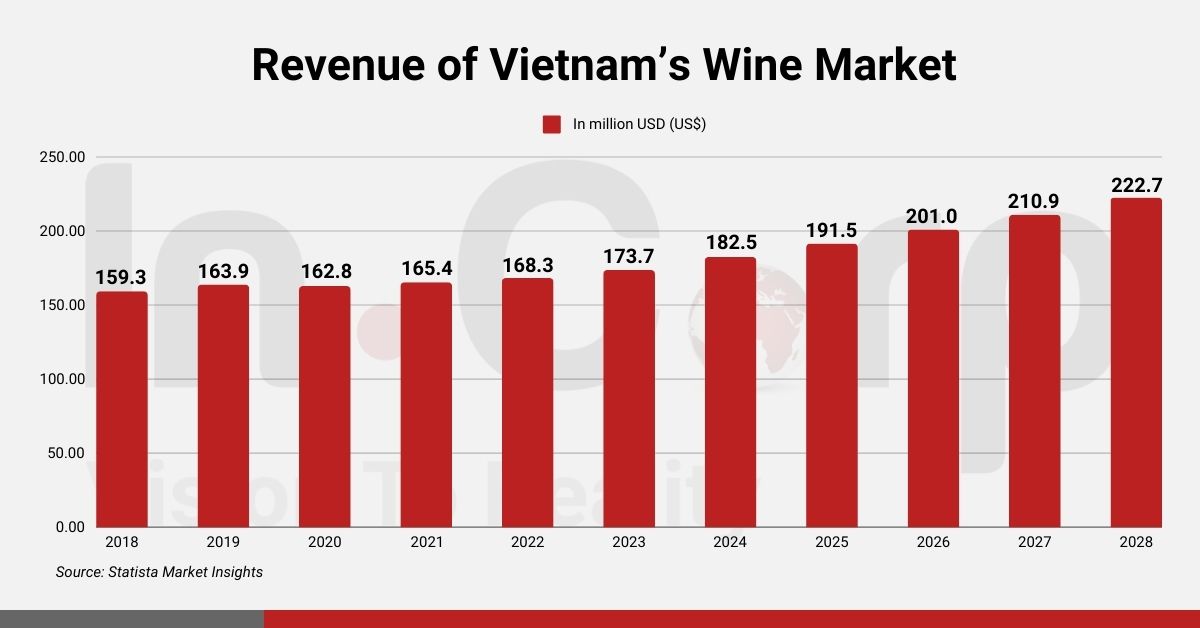

Looking ahead to 2024, Vietnam’s wine market is expected to generate revenues of US$241.9 million, with US$182.5 million from at-home sales and US$59.4 million from out-of-home venues such as restaurants and bars. The forecast for at-home sales anticipates a growth rate of 5.10% annually, achieving a per capita consumption of US$1.83. Additionally, domestic wine consumption is projected to reach 10.4 million liters, averaging 0.10 liters per person.

Vietnam, one of East Asia’s most vibrant economies, has seen its GDP per capita nearly quadruple from 2001 to 2021. The country has also made substantial strides in reducing poverty, with a 10.2% decrease in poverty rates from 2010 to 2020. Despite wine not traditionally being a staple beverage, its consumption is on the rise, expected to reach 13.7 million liters by 2027.

This increase is supported by Vietnam’s strong economic performance, which has maintained an annual growth rate of 7% over the past 23 years, including a 3% growth during the pandemic. The expanding middle class, projected to reach 36 million by 2030, further underscores the potential for growing wine demand. The wine market is anticipated to generate revenues of US$229.20 million in 2023, with a volume increase of 2.5% by 2024.

Significant growth in the Vietnamese wine market was recorded in 2022, with revenues hitting US$347.10 million. By 2030, the market is projected to reach US$692.27 million, growing at a compound annual growth rate (CAGR) of 10.93%. In terms of volume, it reached 16.00 million liters in 2022 and is expected to surge to 24.15 million liters by 2030, with a CAGR of 6.29%.

Target Audience of Vietnamese Wine Market

The country is experiencing a growing interest in wine, with around one million individuals reaching the legal drinking age each year. Additionally, forecasts suggest that the middle class will expand to 95 million by 2030, representing the fastest growth rate in Southeast Asia.

Who Usually Consumes Wine in Vietnam?

Vietnam’s alcohol market is witnessing a discernible shift towards wine consumption, particularly among professionals aged 35 to 45 and older consumers looking for alternatives to high-alcohol drinks. While beer continues to dominate sales, approximately 60% of wine purchases occur on business premises, capitalizing on the popularity of gifting wine during significant occasions such as the Vietnamese New Year.

Despite the majority of wine sales being priced below US$10 per bottle, there is an increasing tendency among aspirational consumers to spend on higher-quality imported wines. Locally produced wines, predominantly from Lam Dong Province, account for 25% of the market share. In terms of imports, Chilean wines are the most popular at 25%, followed closely by French and Australian varieties.

What are Their Behaviours?

In Vietnam, the drinking culture mirrors social norms and regional differences, shaped by the country’s diverse climates and cultural backgrounds. Each region exhibits distinct alcohol consumption patterns. In the North, consumers value packaging and the trendiness of products, often favoring full-bodied red wines such as Shiraz.

In the Central region, residents tend to be more conservative in their brand selections, showing a preference for established names. Conversely, Southerners are more receptive to experimenting with new brands and generally prefer softer red wines, like Cabernet Sauvignon. These varying preferences highlight the unique tastes and cultural nuances across Vietnam.

Read Related: Choosing the Ideal Business Location in Vietnam: The First Step of Success

The Pricing of Vietnam Wine

In Vietnam, wine prices exhibit significant variability influenced by perceived quality, consumer demand for premium labels, and production location. Domestic bottling versus imported bottles can also lead to price differences. Online and offline prices fluctuate, with established brands often commanding higher prices than online ‘home’ brands.

Taxation policies, including a 50% import tax and additional Special Sales Taxes (SST) based on alcohol content, contribute to cost fluctuations. Value Added Tax (VAT) further impacts wine pricing, creating a challenging landscape for importers and distributors amid fierce competition.

Read More: Fundamental Insights: Value-Added Tax (VAT) Landscape in Vietnam

Where to Find Wine?

In Vietnam, the wine market predominantly utilizes traditional distribution channels. Importers frequently manage both distribution and retail sales through their chain stores. Additionally, online sales have become increasingly common, with specialized companies importing and marketing wines under their ‘home’ brands.

Hotels and restaurants often handle their wine imports for on-premise consumption and local distribution. Although direct public advertising of wines is restricted, promotional strategies such as tastings, culinary events, and community gatherings in expatriate circles effectively increase visibility.

Wines are available for purchase in a variety of venues, ranging from supermarkets like Metro and Lotte Mart to specialized wine shops such as Wine Talk and Cellier. These outlets offer an extensive selection of wines from both Vietnam and abroad, catering to the tastes of both residents and the expatriate community in Vietnam.

Regulation on Wine Imports in Vietnam

According to Article 20 of Decree No. 94/2012/ND-CP, the import of alcohol for wine production includes finished wine packaged for immediate consumption. Auxiliary materials and semi-finished liquor must adhere to legal importation regulations and stamping requirements outlined in Article 15. Compliance with Article 14 is mandatory, necessitating proper labeling and adherence to relevant regulations.

Enterprises holding alcohol trading and distribution licenses can directly import wine, ensuring food safety standards. Companies dealing in wine accessories and semi-finished products are restricted from selling to licensed alcohol producers. Those certified for industrial wine production can either directly import or authorize the importation of auxiliary alcohol.

Before importation, alcohol must undergo a declaration of conformity and receive a certification notice. Additional documentation, including distributor authorization or manufacturer agent contracts, must be presented at international border gates alongside customs procedures.

Read Related: Trade Logistics in Vietnam: Top Megaports and Their Impact from Saigon to Hai Phong

Import Tax for Wine in Vietnam

Understanding the tax structure is crucial if you are importing wine in this country. The Harmonized System (HS) code categorizes commodities like wine, determining import tax, VAT, and other applicable taxes. Regulations outlined in Decree No. 94/2012/ND-CP and Circular No. 60/2014/TT-BCT govern wine imports.

Import duties, including a 50% CIF (Cost, Insurance, and Freight) tax, 25% Special Consumption Tax (SCT), and 10% Value Added Tax (VAT), must be settled before shipment confirmation. Wine businesses must also comply with licensing requirements for retailing liquor products in Vietnam, including periodic inspections as mandated by law.

Application for Wine Distribution License

Enterprises seeking to import wine or liquor products directly into Vietnam must obtain a liquor distribution license from the Ministry of Industry and Trade. Unlike standard alcohol products, companies only need to present a food declaration issued by the Food Safety Department during customs clearance for wine products.

Additionally, upon customs clearance, enterprises must possess a license to distribute and import wine specifically for wine products. The imported products must originate from manufacturers approved by the Ministry of Industry and Trade listed in the license sheet.

Regulations For Product Labeling

After clearing customs, each wine product must be stamped, with the General Department of Customs supplying the necessary stamps. Enterprises are allowed to import wine exclusively through international border gates and must have a power of attorney to distribute products within Vietnam. This authorization process includes undergoing consular legalization procedures with the company.

Need Help with Product Labeling? Check out InCorp Vietnam’s Product Registration Services

What if You Consider Selling Alcohol in Vietnam for Your Restaurant’s On-Site Consumption?

If you plan to sell alcohol in Vietnam at your restaurants to enhance customer appeal, you will need to acquire the necessary licenses for alcohol production, distribution, and sale. Specifically, if you intend to sell alcohol directly for on-site consumption, you must obtain a license tailored to this particular activity.

Requirements to Obtain an Alcohol License in Vietnam

Below is the list of key requirements that you must ensure to obtain an alcohol license in Vietnam.

- Legal Establishment: Ensure that the restaurant is legally established according to Vietnamese law, with a fixed location and clear business address.

- Compliance with Regulations: Adhere to fire fighting and prevention regulations as well as environmental protection regulations, especially if selling spirits on-site.

- Proper Licensing: Obtain the necessary alcohol license for the production, distribution, wholesaling, or retailing of alcohol, depending on the restaurant’s activities.

- Required Documentation: Prepare the necessary papers, such as Form #1 and Form #5, along with copies of your business registration certificate and lease agreement for the space you are using. Also, include a copy of your alcohol purchase agreement and a written promise to follow environmental and fire safety rules.

Steps to Obtain an Alcohol License in Vietnam

Below are the steps that you must follow to obtain an alcohol license in this country.

- Submission of Application: Submit the alcohol license application through postal mail, in-person delivery, or online submission.

- Review and Decision: Upon receiving a valid and complete application, the relevant authority will review it within 10 business days. If satisfactory, the authority will proceed with the appraisal process. In case of rejection, the reason will be provided in writing, and the applicant may be required to provide additional documents within 3 working days.

- Premise Inspection: The relevant authority will visit and inspect the restaurant premises to ensure compliance with regulations.

- Issuance of License: Upon successful inspection, the alcohol license will be issued with a 5-year validity period.

Some “Big” Wine Importers in Vietnam

Traditional wet markets and small independent stores prevail in Vietnam’s retail food scene, catering to small-quantity, high-frequency purchases. Meanwhile, modern retailers such as supermarkets, hypermarkets, mini-marts, convenience stores, and department stores are gaining traction among consumers in major urban centers. It includes cities like Hanoi City, Saigon, Hai Phong, Danang, Can Tho, Nha Trang, Quang Ninh, and Binh Duong.

| Retailer Name | Format Type | Nationality |

| SAIGON CO-OP / COOPMART | Supermarkets, Food Stores & Convenience Stores | Local Company |

| METRO CASH & CARRY | Wholesale stores | German company |

| BIG C | Hypermarkets and Supermarkets | JV with Casino Group (France) |

| MAXIMARK | Supermarkets and Department Stores | Local Company |

| FIVIMART | Supermarkets | Local Company |

| CITIMART | Supermarkets and Convenient Stores | Local Company |

| INTIMEX | Supermarkets and Department Stores | JV |

| Saigon Trading Corporation SATRA | Supermarkets and Convenient Stores | State-owned Company |

| Hapro / Hapromart | Supermarkets and Convenient Stores | State-owned Company |

| SELECT | Supermarkets | Local Company |

| PARKSON | Department Stores | Malaysian Company |

| Lotte Mart | Hypermarkets and Supermarkets | Korean Company |

| GIANT | Supermarkets | Singaporean Company (Dairy Farm Group) |

| An Phu | Supermarkets | State-owned Company |

| CT Group | Supermarkets | Local Company |

| Ocean Mart | Supermarkets | Local Company |

| HiwaySuper Centers | Super Centers | Local Company |

Import and Distribute Your Products in Vietnam through InCorp Vietnam

At InCorp Vietnam, we are committed to providing comprehensive services tailored to entrepreneurs exploring opportunities in the Vietnamese market.

Our wine import services are designed to simplify customer access by acting as both purchasing agents and distributors. Furthermore, we offer expert guidance and support for company and product registration in Vietnam.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly