Did you know that: Vietnam’s VAT refund system continues to evolve with significant changes in 2025. The new VAT Law effective July 1, 2025, introduces major compliance updates while maintaining tourist-friendly refund policies. Key highlights include the extension of the 2% VAT reduction until December 31, 2026, and stricter business compliance requirements. To ensure your company remains fully compliant with these evolving VAT and tax regulations, explore our Accounting and Taxation Services.

VAT refunds in Vietnam are a key aspect of doing business in the country that foreign entrepreneurs must comply with. The standard VAT rate in Vietnam is 10%, but Vietnam has implemented significant temporary reductions to support economic recovery. Following the COVID-19 pandemic, the government introduced a 2% VAT reduction. Most importantly, on June 17, 2025, Vietnam’s National Assembly approved extending the 2% VAT reduction until December 31, 2026, meaning eligible goods and services will continue to be taxed at 8% rather than 10%.

This extension represents the most comprehensive VAT reduction scope to date, now including transportation, logistics goods, and information technology services that were previously excluded. In this article, we have discussed the many rules related to VAT tax refunds, including how to claim VAT.

Overview of VAT in Vietnam

In Vietnam, VAT is regulated by the country’s Law on Value-Added Tax 2024, which takes effect from July 1, 2025. According to the law, companies should finalize, declare, and submit their VAT to the local authorities. This can be either done through accounting outsourcing consultancy services like InCorp Vietnam or the company’s accountants.

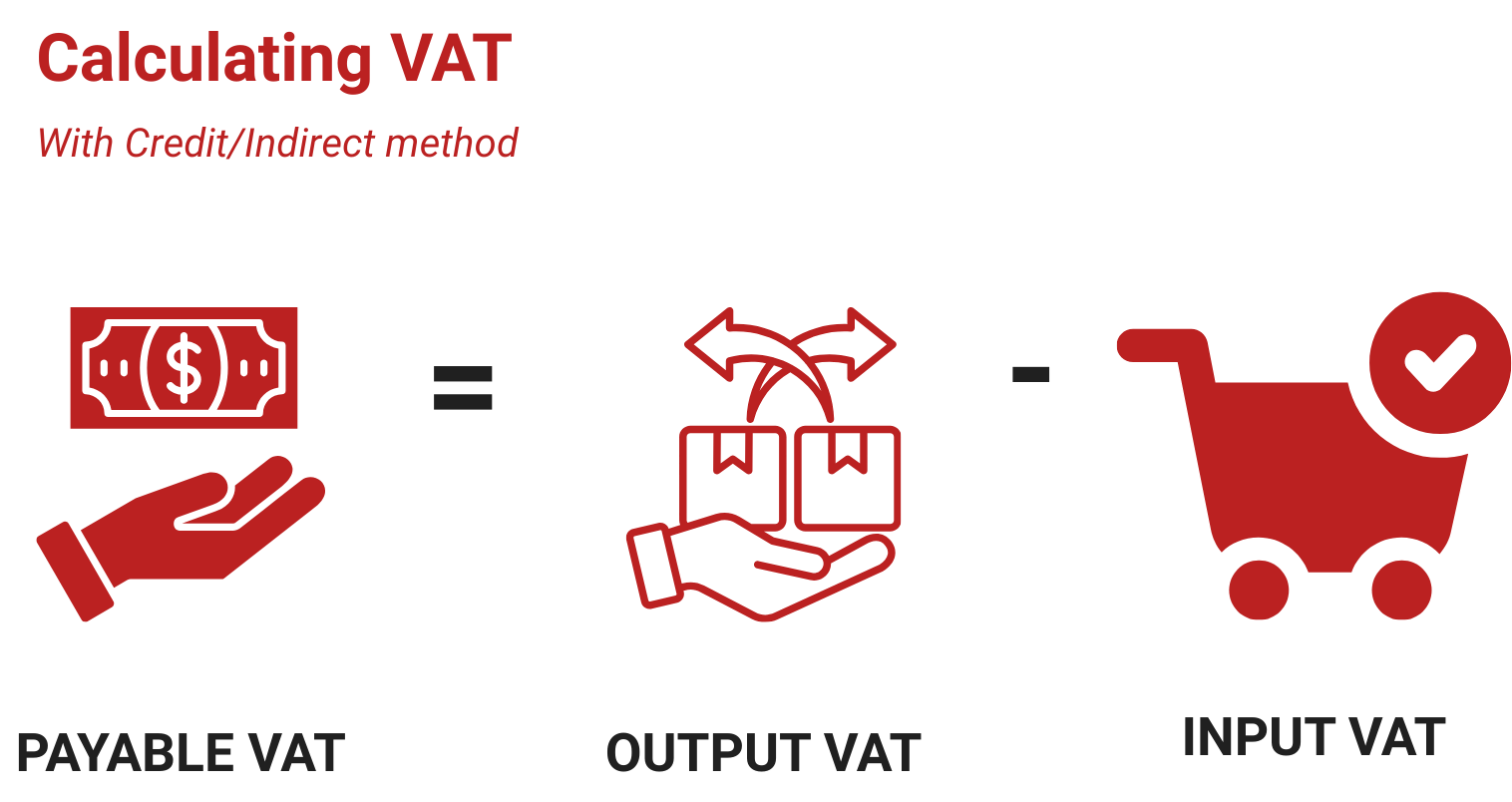

This VAT can be calculated in two ways: the direct credit method used by specific industries, like gemstone and gold processing, and the indirect credit method that most companies use. The payable VAT of companies is the VAT that remains after the input VAT is deducted from the output VAT.

This output VAT is the value-added tax imposed on the consumers who use the company’s goods and services. It is added to the price of the goods on the receipts. On the contrary, the input VAT is levied on the company when it buys raw materials, equipment, and other products from the suppliers to do business. Subtracting input VAT while calculating the payable VAT ensures that the VAT for these materials is eradicated since the company isn’t the end consumer of the products.

Read More: Value-Added Tax in Vietnam: Guide to Navigating VAT for Business Success

What is Vietnam’s VAT Refund and Reduction?

Vietnam VAT refund is defined as the amount of VAT the taxpayer gets from the state budget due to certain issues, like the company miscalculating and overpaying their VAT. However, the Vietnamese government can also offer VAT returns as tax reductions to promote business growth.

As per the new law, foreigners and overseas Vietnamese companies can claim VAT refunds for purchases made in Vietnam while leaving the country. This can be done at the point of sale by furnishing the invoice you get at the VAT refund stores when you purchase goods.

The invoice from the VAT refund stores acts as the tax declaration here. You can also claim a VAT tax refund at the VAT Refund Office for Foreigners Counter by providing your passport, boarding pass, tax invoice, and unused goods details. After inspection of the documents, the Vietnamese authorities will sign a confirmation letter and issue you the VAT refunds in cash.

Under this plan, foreigners can file for a VAT refund within 60 days of departure. They can get up to 85% VAT refunds in Vietnamese currency for paying VAT on eligible goods at the VAT refund stores.

Critical Changes Under New VAT Law 2024 (Effective July 1, 2025)

Key Business Changes

- VAT refund eliminations: The new VAT Law abolishes VAT refunds for ownership changes, mergers, consolidations, separations, or de-mergers, retaining only cases related to dissolution.

- Non-cash payment requirements: All purchased goods and services must have non-cash payment documentation for VAT deduction, with the VND 20 million threshold for cash payments removed. Only specific government-prescribed exceptions will apply.

- E-Invoice compliance: All VAT invoices must be generated through Vietnam’s mandatory electronic invoicing system starting July 1, 2025. Manual or paper invoices are not accepted for VAT refund purposes.

VAT Rate Changes

Rate Increases: Several goods and services will see VAT rate increases from 5% to 10%, including:

- Unprocessed forest products, sugar and by-products

- Educational equipment and cultural sector activities

- Sports activities and film industry

New 5% VAT Items: Previously VAT-exempt items now subject to 5% VAT:

- Agricultural fertilizers and specialized machinery

- Offshore fishing vessels

Expanded Exemptions: New exemptions for imported goods supporting disaster relief and epidemic prevention

Eligibility for VAT Refund Vietnam

A VAT refund in Vietnam is issued to a company when its total input VAT for 4 quarters or 12 months has not been deducted from its output VAT. This is because the company didn’t file the input VAT deductions, resulting in an overpayment in its annual payable VAT. However, only businesses that use the credit method for filing VAT are eligible for a Vietnam VAT refund, as it takes into account both input and output VAT.

The Vietnamese government also provides VAT refunds as a tax incentive in cases like these:

- Investment projects: Investment projects (including oil and gas companies) that have been investing and have uncredited input VAT of at least VND 300 million (about US$11,902) on goods and services for their investment. Under the new law, businesses must meet stricter compliance requirements, including complete charter capital contribution and proper business condition fulfillment

- Only dissolution cases are eligible for VAT refunds under the new law. Ownership transfers, M&A, consolidations, and separations no longer qualify for VAT refunds.

- Companies that have filed over VND 300 million or US$11,902 of uncredited input VAT on exported goods and services.

Notes: Enhanced processing timelines

- Fast-track processing: 6 working days for eligible applications

- Standard verification: Up to 40 days for detailed review

- Complex cases: Some businesses report delays up to 5 years for complicated situations

Companies have to keep in mind that the answer to “How to claim a VAT refund?” lies in strictly following certain requirements, like

- Investment Registration Certificate (IRC),

- Enterprise Registration Certificate (ERC),

- The company stamp,

- Electronic accounting documents and financial statements (paper documents no longer accepted),

- The company bank account, which is used for investment capital,

- An accurately filed refund application.

- Non-cash payment documentation for all transactions.

According to the Ministry of Finance, VAT-refunded goods should fulfill the following conditions:

1. The purchase of unused goods allowed on aircraft can be subject to VAT.

2. Goods you have bought should not be on the list of export prohibitions or restrictions.

3. The goods bought can’t have VAT refund declarations or invoices issued after 60 days of departure

4. The purchased goods must be bought from only one particular VAT refund store over a one-day period, provided they have a valuation of VND 2.000.000.

Refund Process for Tourist

Most foreigners are not aware of how to claim VAT refunds in Vietnam. Here’s a brief explanation of the process:

- Step 1: Inform the staff at the payment counter that you want a tax refund receipt, for which you have to show your passport so that the VAT refund declaration form can be created. Ensure you shop at stores displaying clear VAT refund signage and meet the minimum VND 2,000,000 purchase requirement per store per day.

- Step 2: Once this is done, you will get an original tax refund receipt. You need to furnish the original receipts of purchase and the tax refund receipt later to get the refund. Verify all information is correct on the invoice before leaving the store.

- Step 3: Pack your purchased goods, passport, and VAT declaration form separately so that you can easily show them to the airport staff when they ask for them for customs clearance and inspection.

- Step 4: At the airport, head straight to the VAT refund customs inspection office for clearance. This must be done before check-in if goods are in checked baggage, or after security if goods are in hand luggage.

- Step 5: Once all the paperwork is done, you will be asked for the boarding pass, which will then lead you to submit the check-in luggage at the Tax Refund Desk to get the refund in Vietnamese dong. A maximum 15% service fee can be charged at customs clearance.

- Since the refund is in cash and Vietnamese currency, you have to convert it to your desired currency at the currency exchange center. At the Noi Bai airport, you can do this at Vietcom or the Maritime Bank, while at Tan Son Nhat airport, you can head to VietinBank and BIDV exchanges.

Available Airports and Locations

VAT refunds are available at:

- Noi Bai International Airport (Hanoi) – Counter near departure gates 8-9

- Tan Son Nhat International Airport (Ho Chi Minh City)

- Da Nang International Airport

- Cam Ranh Airport

- Select international seaports

Current VAT Rates and Exemptions (2025-2026)

As per the latest June 2025 resolution, foreigners and businesses that adopt the VAT credit method can get the reduced 8% VAT rate until December 31, 2026 at all stages, including manufacturing, processing, imports, and trading. However, certain products and services like banking, insurance, real estate trading, telecommunications, financial activities, securities, mining products (except coal), petroleum and chemical products, coke, metals, and prefabricated metal products are exempt. Also, information technology services and goods under the Special Consumption Tax aren’t subjected to the reduced VAT rate.

Notes: NEW INCLUSIONS in 2025-2026 reduction (previously excluded)

- Transportation and logistics services

- Information technology services

- Various goods and services not previously covered

Read Related: A Comprehensive Guide to Corporate Tax and Compliance Obligations in Vietnam

Applying for VAT Refund Vietnam

Applications for a VAT refund in Vietnam are done online through the government’s online tax management platform, which is only available in Vietnamese. Under the new law, all applications must include electronic invoice documentation and non-cash payment evidence. Another hurdle in the application process is that specific types of businesses have to follow specific procedures, like furnishing details of new investments and importing activities.

Hence most companies outsource the VAT refund application process to corporate consultancies like InCorp, which have an expert team supported by adequate resources, which expedites it. Businesses can outsource payroll and recruitment, legal representative, and secretarial requirements, along with accounting and tax compliance.

Consultancies like InCorp can help you get the VAT tax refund after fully assessing your eligibility status, which requires the following steps:

- Collecting all the relevant information and documents of your company

- Conducting a thorough compliance check including new e-invoice requirements.

- Consulting the conditions of the VAT refund under the updated 2024 law.

- Liaising with the company’s local authorities to meet the requirements of your specific field and business type.

InCorp Vietnam prepares and submits the VAT refund application only when all conditions are fulfilled and both the company and the officials are satisfied. To achieve this, the consultancy does all the research and legal inspection for the company and prepares company dossiers. This also includes settling disputes in the application by speaking to the Vietnamese tax authorities.

Once all is in order, you can go through the procedure yourself by submitting the prepared documents from the Tax Department for the tax refund.

As per Vietnamese law effective July 1, 2025, dossiers for VAT tax refunds for businesses with conditional business lines need the following details:

- Form No. 01/HT duly filled

- IRC and investment license copy

- Land Use Right Certificate (LUR) copy issued by a competent authority ensuring lease or land allocation

- Construction Permission Certificate copy for projects involving construction works.

- Charter capital contribution certificate copy

- List of invoices and documents designated in Form No. 01-1/HT with electronic invoice compliance

- The decision on the establishment of the project management board/assignment of project management tasks by the project owner

- The organization and operation regulations of the branch or project management board if the tax refund is applied for by the branch or project management board

- Non-cash payment documentation for all transactions

Impact of VAT Reductions

Similar to other countries across the world, Vietnam introduced temporary VAT reductions to recover from the COVID-19 pandemic’s effect on businesses. This was done to boost those sectors that were heavily impacted during the pandemic by supporting companies and increasing demand.

In China, VAT was exempted for small businesses selling goods in Hubei, along with a 2% reduced rate in other areas from March 1 to May 31, 2020.

Meanwhile, South Korea introduced a 70% VAT reduction on car purchases from March to June 2020. Whereas Thailand reduced import duties on GG products classified as medical supplies from March 26 to September 30, 2020.

However, South Korea’s National Assembly is reviewing a bill (No. 2200476) to extend tax breaks for eco-friendly cars. The proposed amendment to the Special Taxation Act would prolong reduced individual consumption tax on hybrids, EVs, and hydrogen vehicles for two more years, pushing the current deadline from the end of 2024 to the end of 2026.

The reduced rate of VAT (down from 10% to 8%) in Vietnam now extended until December 31, 2026, has helped businesses in the following ways:

- Lowered input costs: Businesses across sectors could lower their input costs because of the reduced tax;

- Increased consumption: Stimulated domestic consumption by allowing people to save on expenses and living costs.

- Bolstered economic growth: Supported economic growth and maintained macroeconomic stability.

- Helped to recover: Helped businesses recover from the financial strains of the past few years.

Read More about InCorp Vietnam’s Comprehensive Accounting Outsourcing Services

Take away: Expert Tips for Foreign in 2025-2026

For tourists:

- Allow extra processing time: VAT refund procedures can take 30+ minutes at airports

- Shop strategically: Focus on stores with clear VAT refund signage and verify minimum purchase amounts

- Keep goods pristine: Ensure items remain unused and in original packaging

- Arrive early: Complete customs procedures before check-in for checked baggage items

- Organize documents: Keep all receipts, passport, and forms easily accessible

For businesses:

- Prepare for compliance changes: Ensure all systems can handle mandatory e-invoice requirements by July 1, 2025

- Update payment methods: Transition to non-cash payment documentation for all transactions

- Review refund eligibility: Many traditional refund categories (M&A, ownership changes) are eliminated under new law

- Consider professional assistance: Complex refund applications may require specialized tax consultation

- Plan cash flow: With stricter requirements, refund timelines may extend beyond previous experiences

Getting Updated on Vietnam’s Value-Added Tax (VAT) with InCorp Vietnam

At InCorp Vietnam, we know the importance of tax reliefs, and hence, we help businesses navigate the ever-changing tax laws. Our skilled tax and compliance team stays updated on the latest tax regulations in Vietnam and can help you update your tax refund applications accordingly, ensuring that you experience no rejections and penalties.

A Guide to Corporate Taxes and Compliance Work in Vietnam

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Can You Claim Tax Back In Vietnam

- Yes, Vietnam offers a VAT refund for eligible goods purchased by foreign tourists. Refunds can be claimed at designated airports upon departure, subject to specific conditions and documentation.

How can I claim a VAT refund?

- To claim a VAT refund in Vietnam, a business must meet certain conditions, such as having input VAT greater than output VAT for at least 12 consecutive months (or a minimum of 300 million VND in refundable VAT for export enterprises in a quarter). The refund claim is submitted to the tax authority via a VAT refund application, along with supporting documents like VAT invoices, customs declarations, and proof of payment. The tax authority will review the documents and may conduct a tax audit before approving the refund. The process typically takes 15–40 working days depending on whether a pre-refund audit is required.

How To Avoid Vat Tax

- To avoid VAT legally, ensure your business qualifies for VAT exemption or stays below the VAT registration threshold in your country. You may also use VAT-free suppliers or operate in jurisdictions without VAT. Always consult a tax professional to ensure compliance with local laws.

Is it worth getting a VAT refund?

- Yes, getting a VAT refund can be worth it if your business incurs significant VAT on purchases and is eligible to reclaim it. For companies registered for VAT in Vietnam, claiming refunds can improve cash flow by recovering input tax that exceeds output tax, especially in the early investment phase. However, the process can be complex and time-consuming, so it's important to ensure compliance with all documentation and regulatory requirements.