Vietnam boasts a rich coffee culture which is deeply rooted in its history. French colonists introduced this beverage in the 19th century. Over time, it has become an integral part of Vietnamese society, shaping daily routines and social interactions. From Saigon’s bustling streets to small towns’ quaint roads, coffee shops dot the landscape, offering spaces for relaxation and companionship at any hour. As Vietnam’s coffee industry grows and focuses on exports, it’s important to use reliable company formation services to build credibility and ensure trade compliance.

Today, the coffee shop industry in Vietnam is thriving. Ground coffee, whole beans, and instant coffee cater to various consumer preferences, with a notable shift towards instant coffee due to modern lifestyles and convenience. As consumer demands evolve, both domestic and international companies compete for market share in the country’s competitive landscape, pushing innovation and adaptation.

History of Coffee in Vietnam

The journey of coffee traces back to 1857 when a French Catholic priest introduced an Arabica tree to Northern Vietnam. However, in the early 1900s, the high-yielding Robusta bean was introduced to the country’s central highlands. The region’s favorable climate and soil conditions provided an ideal environment for its cultivation and growth. Over time, coffee plantations flourished in regions like Dak Lak province, pushing the country into a significant player in the global coffee market.

The turning point came in 1987 with the ‘Doi Moi’ economic reforms, catapulting Vietnam onto the international stage and cementing its position as the world’s second-largest coffee exporter. Today, this country exports more than 1.65 million metric tonnes of coffee annually, particularly in Robusta beans. It represents a substantial portion of the world’s coffee production.

Coffee is a lifeline for millions of people in this country, with an estimated 3 million individuals relying on the coffee industry for their livelihoods. From colonial roots to modern-day dominance, the country’s coffee industry is a testament to resilience, innovation, and the enduring importance of coffee in the nation’s economy and culture.

Vietnam – The Second-largest coffee Exporter

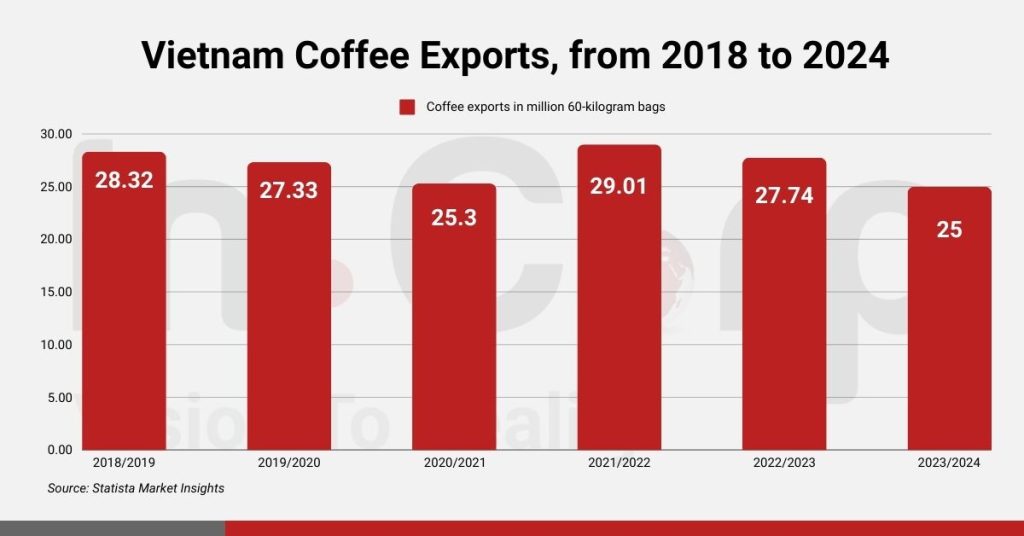

Vietnam is the world’s second-largest coffee exporter and producer of robusta coffee. It accounts for approximately 95% of its annual coffee output, which is 30.1 million (60kg bags). Recent data from the Import-Export Department reveals that in the first two months of 2022, this country exported 293,000 tons of coffee and generated US$674 million in revenue. This was an increase of 3.4% in volume and a staggering 35.6% in value compared to the same period in 2021.

The Europe-Vietnam Free Trade Agreement (EVFTA) presents further opportunities as the Ministry of Agriculture and Rural Development focuses on expanding the EU’s agricultural exports, including coffee. Additionally, the country’s coffee brands are making strides globally, with plans for expansion into the US market by major exporters like TNI King Coffee and emerging chains like Phuc Long Coffee & Tea.

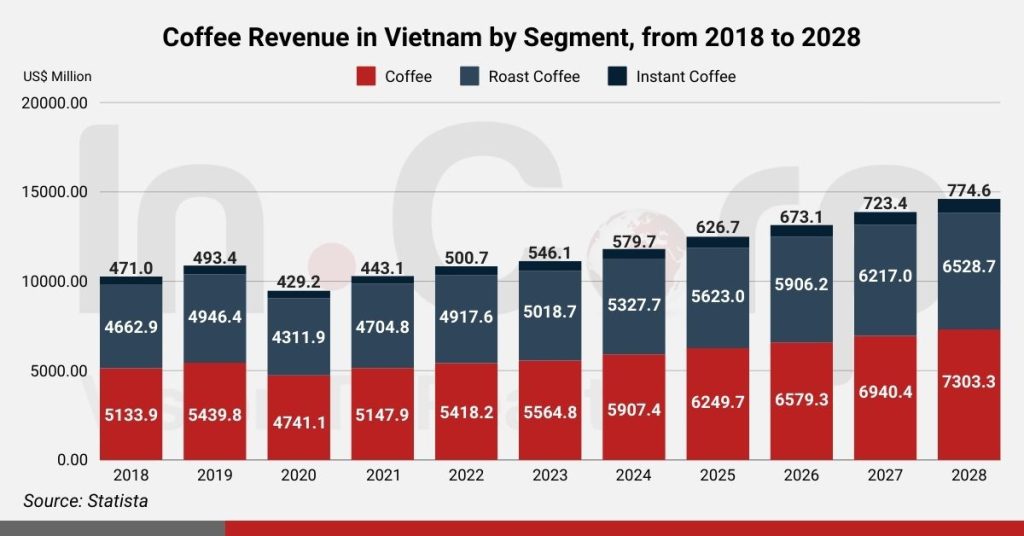

According to Statista, Vietnam’s coffee segment was projected to rake in approximately US$5.90 billion in 2022, with a forecasted annual growth rate of 5.99% between 2022 and 2025.

As coffee consumption continues to surge, especially in out-of-home settings like cafes and restaurants, it is evident that Vietnamese coffee’s allure extends far beyond home brewing. By 2025, it is estimated that 78% of spending and 21% of volume consumption in the coffee segment will be tied to out-of-home consumption.

The coffee market is experiencing a landscape dominated by a few major players. Noteworthy competitors in Vietnam’s Coffee market include Nestlé S.A., Metrang Coffee, Jollibee Foods Corporation, Masan Group, and Trung Nguyên.

With a market estimation of US$511.03 million in 2024, it is projected to reach US$763.46 million by 2029 at a CAGR of 8.13%; coffee culture continues to flourish. Expanding global exposure, western influence, and the emergence of premium coffee chains such as Highland’s Coffee, Starbucks Corporation, Phuc Long, and Trung Nguyen are key drivers pushing market growth. This growth is further driven by the rise of upscale coffee shop formats, presented by The Coffee House’s new upscale brand, SIGNATURE.

With the country’s population steadily increasing by about one million people per year, the coffee industry is poised for significant growth, buoyed by improving coffee quality. The Vietnam Coffee and Cocoa Association (VICOFA) aims to double the value of the country’s coffee exports to US$6 billion by 2030.

Interested in the Vietnam’s Coffee Export Market? Check out InCorp Vietnam’s Incorporation Services

Vietnam Coffee Market: Understanding Culture and Changing Trends

As stated earlier, Vietnam’s coffee culture is rooted in French colonial influence from the 19th century. But, it is now deeply ingrained in local daily life. Unlike its American counterpart, the coffee culture is characterized by democratic variety rather than hierarchy.

The instant coffee market is projected to reach US$703.8 million by 2027, growing at a CAGR of 12.91%. With the rise of high-end coffee retail chains, Vietnam also imports coffee beans and instant coffee to meet demand from countries like Indonesia, Laos, Brazil, and the United States.

The Rise of Vietnamese Coffee Culture

The country’s rich coffee culture, steeped in tradition, offers a sensory journey into the heart of its identity. Today, it stands as one of the world’s top coffee producers, deeply intertwined with its quest for independence.

According to Standard Insights’ Consumer Report Vietnam 2022, coffee held the top spot among Vietnamese consumers, reflecting the nation’s growing coffee culture. Approximately 39.6% of consumers buy coffee, followed by soft drinks (35.6%) and bubble tea (30.7%). Meanwhile, soft drinks are more prevalent among female citizens (44.3%). In comparison, nearly 51% of male citizens choose coffee as their favorite beverage.

This trend was further fueled by the addition of coffee shops, particularly in cities like Ho Chi Minh City and the historic capital of Hanoi. It was driven by both local enthusiasm for quality coffee and the influence of Western coffee culture brought by foreign visitors and residents.

Read Related: 9 Reasons to Choose Ho Chi Minh City in Vietnam to Launch Your Business or Hanoi Business Incorporation Guide: Opportunities, Requirements, and How-To Steps

Coffee Shop Industry in Vietnam

The coffee shop industry in Vietnam has witnessed rapid growth recently, with projections indicating an 8.5% CAGR from 2020 to 2025. This expansion is chiefly driven by the nation’s urban population, comprising over half of 97 million residents and those under the age of 35.

Young city dwellers are increasingly embracing coffee shop culture, often frequenting these establishments for socializing, work, and leisure activities. Additionally, the burgeoning middle class, benefiting from increased disposable income, contributes to market growth by indulging in leisure activities like coffee shop visits.

Vietnam boasts diverse coffee shop chains that compete fiercely on pricing, quality, variety, customer experience, and location. As new entrants join and existing players expand, competition in the country’s coffee shop market will intensify further in the coming years.

Increasing Demand For Specialty, Organic, and Green Coffee

The demand for organic food and beverages, especially tea and coffee, is rising in Vietnam. It is mostly propelled by shifting lifestyle patterns and increased spending on food and drinks. Factors such as health consciousness, changing meal habits, and a desire for new tastes contribute to this trend.

Organic certification is becoming necessary as sustainability is paramount for buyers and retailers. Consumers and the industry are placing greater emphasis on traceability throughout the value chain, reflecting the growing preference for organic products. According to FAO, Vietnam’s coffee production remained robust in meeting consumer demand, with green coffee production totaling nearly 1.85 million tonnes in 2021.

Market players are responding by offering organic coffee in various packaging formats, driving the market growth. Brands like L’amant Cafe are introducing innovative organic coffee products, including instant coffee and whole beans, that meet international standards and cater to evolving customer preferences. These initiatives demonstrate a commitment to innovation and customer satisfaction, fostering further market expansion.

Instant Coffee is Gaining Traction in the Market Due to the Rising Demand

As Vietnamese lifestyles become busier and work hours increase, convenience becomes paramount. It fuels a shift towards instant coffee mixes over traditional options like fresh ground or standard instant coffee. This transition is further propelled by the packaging formats offered by brands like TNI King Coffee and G-7 in Vietnam. They present single-serve sachets or sticks, which are gaining popularity due to their ease of use and eco-friendliness.

The surge in instant coffee production in this country plays a pivotal role in meeting this growing demand, with production volumes steadily increasing to align with market needs. In 2022, Vietnam made much more powder and instant coffee than in 2021. The production volume increased to about 154 thousand metric tonnes, up from 141.4 thousand metric tonnes, as reported by the General Statistics Office of Vietnam.

With its abundant Robusta coffee resources, the country holds the potential to dominate the global instant coffee market. Major players in the Vietnamese coffee industry are expanding their manufacturing capabilities to capitalize on this advantage.

Demand for Better Quality Coffee

With Vietnam’s flourishing coffee culture, farmers and retailers constantly work on innovation to enhance product reputation and quality. The country has a rich history of mass coffee production but now it is focused on establishing itself as a producer of high-quality coffee.

According to VSCA (Vietnam Specialty Coffee Association), Vietnamese coffee roasters and cafe owners are dedicated to delivering superior coffee. They prioritize factors like terroir and discuss cultivation methods with farmers. Additionally, they are committed to implementing best practices in processing techniques.

Prospects of Coffee Exports from Vietnam

The Vietnam Coffee and Cocoa Association has set an ambitious goal of doubling coffee export turnover to US$5-6 billion by 2030. To achieve this, they aim to increase the proportion of processed coffee products from less than 10% to around 25% or more.

The global coffee market is also affected by inflated prices and disrupted distribution due to the COVID-19 pandemic. As the industry seeks to scale up coffee processing, attracting investors is essential for sustainable development.

In 2022, Vietnam maintained its position as the world’s third-largest coffee exporter, with coffee exports totaling US$3.37 billion. Also, coffee ranked as the 25th most exported product from Vietnam in 2022. Germany, Italy, the United States, Belgium, and Spain were the top destinations for coffee exports, with Germany leading at US$484 million, followed by Italy at US$347 million, and the United States at US$308 million.

Notably, Belgium, Italy, and Germany experienced the fastest growth in coffee imports from Vietnam between 2021 and 2022, with increases of US$73 million, US$118 million, and US$99.8 million, respectively.

In 2023, the average export price of coffee in Vietnam soared to US$2,834 per tonne, a 14.1% increase from 2022. The increase was mainly because Robusta coffee prices surged to their highest level in 28 years. Forecasts suggest that the cost of Robusta coffee will continue its upward trajectory in 2024, potentially reaching unprecedented heights amid concerns about supply shortages.

Despite favorable pricing trends, Vietnam’s coffee production for 2023-2024 is anticipated to decline to 1.6-1.7 million tonnes, down from 1.78 million tonnes from 2022-2023, as the Vietnam Coffee-Cocoa Association (VICOFA) reports. In response, the country is prioritizing measures to ensure the sustainable development of its coffee industry.

Efforts include enhancing origin traceability and adhering to the European Union deforestation regulation (EUDR). These initiatives aim to bolster the resilience and longevity of Vietnam’s coffee sector amidst evolving global market dynamics.

Some Leaders in the Vietnam Coffee Market

According to market research conducted by Standard Insight Vietnam, Trung Nguyen emerges as the top coffee brand in Vietnam, capturing the preference of 33.7% of respondents.

Notably, the study reveals a gender disparity in brand preference. Most men like Trung Nguyen Coffee the most, with 45.8% saying they prefer it. On the other hand, women tend to prefer Highlands Coffee more, with 30.7% saying it is their favorite. This nuanced insight underscores the diverse preferences within the country’s coffee culture, shedding light on the distinct brand loyalties among different demographic segments.

Conclusion

For over 150 years, coffee has played a significant role in Vietnam’s culture and economy. In many parts of the country, traditional coffee customs remain strong. However, there is a growing interest in specialty coffee among the younger generation and middle class. This shift signifies an exciting evolution as Vietnamese coffee appreciation grows and local beans garner recognition.

Nonetheless, coffee will remain a cornerstone of this country’s identity and economic landscape for generations to come. Its future trajectory is expected to embrace both long-standing traditions and emerging trends.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Does Vietnam Export Coffee

- Yes, Vietnam is one of the world's largest exporters of coffee, particularly known for its robusta beans.

How large is the coffee shop industry?

- As of 2023, the global coffee shop industry is valued at over $165 billion, with steady annual growth driven by increasing coffee consumption and urbanization. In Vietnam, the coffee shop market is also expanding rapidly, fueled by a young population, rising disposable incomes, and a strong local coffee culture.

How many coffee shops are there in Vietnam?

- As of recent industry estimates, there are over 30,000 coffee shops operating throughout Vietnam. This includes both independent cafés and major chains like Highlands Coffee, The Coffee House, and Trung Nguyên. The number continues to grow due to strong coffee culture and increasing local and tourist demand.

How Much Coffee Does Vietnam Export

- Vietnam exports approximately 1.5 to 1.8 million metric tons of coffee annually, making it one of the world's largest coffee exporters. The majority of its exports are robusta beans.