Vietnam is solidifying its status as a dynamic hub for global business and investment. In the first quarter of 2024, the country’s startups, especially in the tech sector, displayed robust growth, an increase from the previous quarter. This surge positions Vietnam as a top destination for seed-stage funding in Southeast Asia. The expansion of initiatives like the CPTPP and increased Taiwanese investments in industrial parks highlight Vietnam’s strategic economic role globally. As more investors recognize these trends, several are taking steps to set up their companies in Vietnam to participate in the country’s rapidly expanding startup and innovation ecosystem.

Vietnam is enhancing its infrastructure and international trade capabilities, including e-governance in the north and major seaport projects. These developments, coupled with investments from global corporations like BOE and Hyosung, are spurring Vietnam economic growth and job creation. Continuous improvements in regulatory frameworks and a commitment to sustainability are making Vietnam increasingly attractive for foreign investments, positioning it for greater global economic integration.

Vietnamese Startups Secure $35.7M in Q1 2024

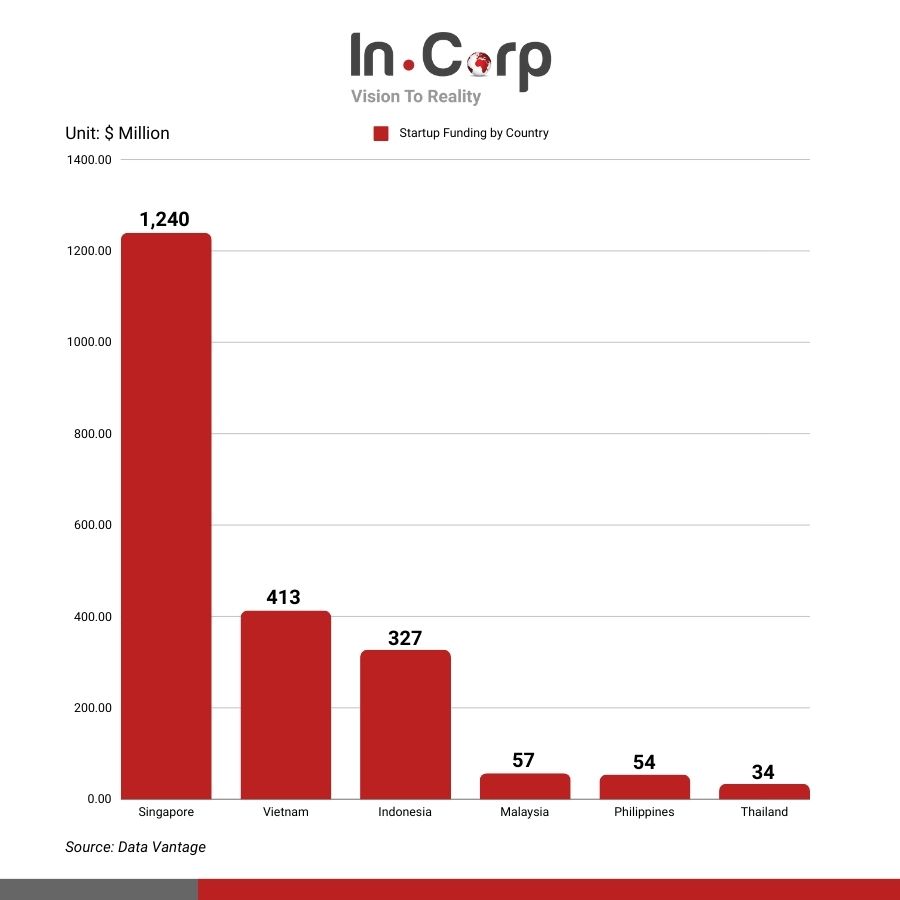

Vietnamese startups raised US$35.7 million in Q1 2024, marking a significant recovery with a 467% increase from the previous quarter, despite a 39% decrease from the same period in 2023. This funding ranked Vietnam third in Southeast Asia, with the majority, US$31.2 million, allocated to early-stage ventures.

The tech sector, led by Be Group’s US$31.2 million series B round, dominated the funding landscape, particularly in auto tech and edtech. However, investment in enterprise applications fell to US$1.5 million from US$4 million in the previous quarter, reflecting a selective approach in a fluctuating market.

Read Related: Vietnamese Unicorn Startups: Revolutionizing Southeast Asia with High-Value Players

CPTPP Expansion Boosts Vietnam’s Trade

Five years after its inception, the CPTPP continues to grow, offering Vietnam new trade and investment expansion opportunities as more countries express interest in joining. Currently, the CPTPP has a combined GDP of approximately US$11 trillion, with nations like China, South Korea, and Thailand looking to join, potentially boosting Vietnam’s economic ties significantly.

In 2023, Vietnam’s trade with the UK under the CPTPP reached US$5.92 billion, showing robust growth. The addition of the UK and other potential members could enhance market access for Vietnam, supporting its industries and expanding its economic footprint in the Indo-Pacific region.

Read More: Guide to Vietnam’s 16 Active Free Trade Agreements

Northern Provinces Advance in E-Governance

In 2023, Haiphong, Hung Yen, and Hai Duong advanced in e-governance, yet showed varied PAPI scores, reflecting differences in public service provision and corruption control. Haiphong’s notable scores include 7.99 in public services and 4.98 in grassroots participation, while Hung Yen scored high in transparency at 5.5 points.

Adoption of e-governance in Vietnam is slow, with under 9% of citizens using national or provincial e-service portals, attributed to privacy concerns. This shift toward digital platforms is critical for improving administrative efficiency and transparency, despite the current low engagement rates.

Interested in Investing in Vietnam? Check out InCorp Vietnam’s Incorporation Services

Seaport Investment Spurs New Opportunities

Vietnam is set to invest an estimated US$14.83 billion in seaport systems by 2030, enhancing infrastructure and upgrading key ports like the city of Ho Chi Minh and Lien Chieu. The master port development plan also includes expanding international gateway areas such as Lach Huyen, Cai Mep, and Can Gio, aiming to meet rising transshipment demands.

International investments are intensifying, with Indian multinational Adani Group planning a US$2 billion project at Lien Chieu Seaport. Moreover, projects like the Tran De offshore port and Can Gio international port are prioritized to streamline operations and attract more global investors.

Read More: Trade Logistics in Vietnam: Top Megaports and Their Impact from Saigon to Hai Phong

Vietnamese Parks Seek Taiwanese Investment

Vietnam’s industrial parks, such as Thang Long and Gilimex, are actively courting Taiwanese investment, offering large parcels of land to prospective investors. With aims to expand production and manufacturing capacities, these parks currently house a few Taiwanese firms among many Japanese tenants.

Investment from Taiwan surged to US$2.2 billion in 2023, marking a four-fold increase from the previous year and establishing Taiwan as one of Vietnam’s top foreign investors. This influx is part of broader efforts to attract more investment into Vietnam’s 414 industrial parks, which require an estimated US$72 billion for infrastructure development by 2030.

Read More: Vietnam’s Industrial Zones: A Key Player in Global Manufacturing

BOE’s US$275M Ba Ria-Vung Tau Factory Launch

China’s BOE Technology Group has initiated the second phase of its smart terminal project in Vietnam with an investment of US$275 million, aimed at producing over 134.7 million high-resolution screens and other components annually. This expansion is projected to generate US$1 billion in yearly revenue and create over 4,000 jobs.

This project underscores BOE’s commitment to leveraging Vietnam’s strategic location for growth and enhancing its global service delivery in the display industry. The rapid approval and start-up of the project reflect Ba Ria-Vung Tau province’s business-friendly and transparent investment environment.

Read Related: China +1 Strategy in Vietnam: An Overview for Chinese Investors

Vietnam Gears Up for US Investments

Vietnam is poised to capitalize on substantial U.S. investments, highlighted by Suntory PepsiCo Vietnam’s recent groundbreaking on a US$300 million factory in Long An. This state-of-the-art facility, powered by renewable energy, will boost the company’s local market presence with an annual capacity of 800 million liters.

Despite only US$17.26 million registered by U.S. firms in Vietnam for Q1, companies like Ford, Boeing, and AES are deepening their commitments, with investments spanning high-tech and energy sectors. Vietnam’s strategic enhancements in regulatory and investment frameworks aim to further attract U.S. capital, emphasizing its potential as a pivotal economic partner.

Read More: Updates on US Investments in Vietnam: A Surprisingly Fruitful Partnership

Hyosung, LS Eco Boost Vietnam’s Economy

Hyosung TNC of South Korea is investing US$1 billion to build the world’s largest bio-spandex factory in Vietnam, aiming to produce 200,000 tonnes of sustainable materials annually. This initiative targets a US$75 billion market by 2030, with plans to boost sustainable spandex sales significantly.

LS Eco Energy has partnered with Vietnam’s Institute of Energy to integrate superconducting cables into the power grid, enhancing capacity fivefold with minimal environmental impact. This addresses the growing electricity needs of urbanization and data centers.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly