Vietnam has become a top choice for expats who are looking to get settled abroad. With its growing economy and rich cultural heritage, this country is offering attractive opportunities. As of 2022, almost 1,00,000 foreigners have made this country their home because of its affordable cost of living, growing job market, and great lifestyle.

Vietnam’s burgeoning economic growth makes it a great place to start a new business or one who is looking for work. Many big companies predict that Vietnam will become one of the world’s strongest economies by 2050, which means that there is a need for skilled workers.

However, there are lots of things to consider for living in Vietnam. These things include planning for getting the right visa, finding the right place to live, sorting healthcare options, and paying taxes.

Need help with a Work Permit in Vietnam? Check out InCorp Vietnam’s Immigration Services now!

Living in Vietnam Permanently: Essentials for Expats to Take Care Of

Residency Process

To live in Vietnam permanently, you need to know your way around all the legalities and processes. The Vietnamese government has prescribed a three-tier system for foreigners who are looking to live in this country. It includes a working visa, temporary residency, and permanent residency.

First things first, you need to grab yourself a work permit. They remain valid for up to 2 years and must be obtained two weeks before your employment start date. The qualifications for the work permit are:

- You must be at least 18 years old

- You have secured a job in Vietnam

- You have to provide a good health status

- You must not have any criminal record

Professional qualifications include:

- Holding an undergraduate degree or

- Have a relevant work experience of 5 years in your field

After obtaining a work permit for living in Vietnam, you need a Temporary Residence Card (TRC). This residency card is valid for 1 to 3 years but can also be extended. To qualify for this card, you need:

- A work permit

- An investment certificate

- Proof of status in Vietnam

The TRC is subject to return to the immigration authorities and you have to submit your work permit to the employer.

However, if you are looking to stay for a long period of time, a Permanent Residence Permit is required. It will be available if you have lived for at least 3 years in Vietnam. They need to be renewed every ten years. To qualify for a permanent residence permit you must:

- Provide proof of stable income

- Have a temporary residence permit

Financial Considerations and Banking

Banking Services

Banks in Vietnam offer two main types of accounts for foreigners, i.e., personal and business accounts. For a personal account, you have to make an initial deposit and should have:

- A temporary residency card

- Proof of employment, such as a work contract

- Proof of Vietnamese address

The business bank account needs additional documents. You should have a legal representative to countersign your application and along with that you need to have:

- Proof of business legitimacy

- Registered address in Vietnam

- Operating license

- Tax return documents

Vietnamese Currency

Vietnam has a unique currency system that offers three different forms of payment. The Vietnamese Dong (VND) is the primary source of daily transactions, while the US dollars are used for luxury items and gold is the traditional currency to buy and sell land or house. This shows that the economic structure of Vietnam is complex and provides flexible transactions.

Tax Obligations

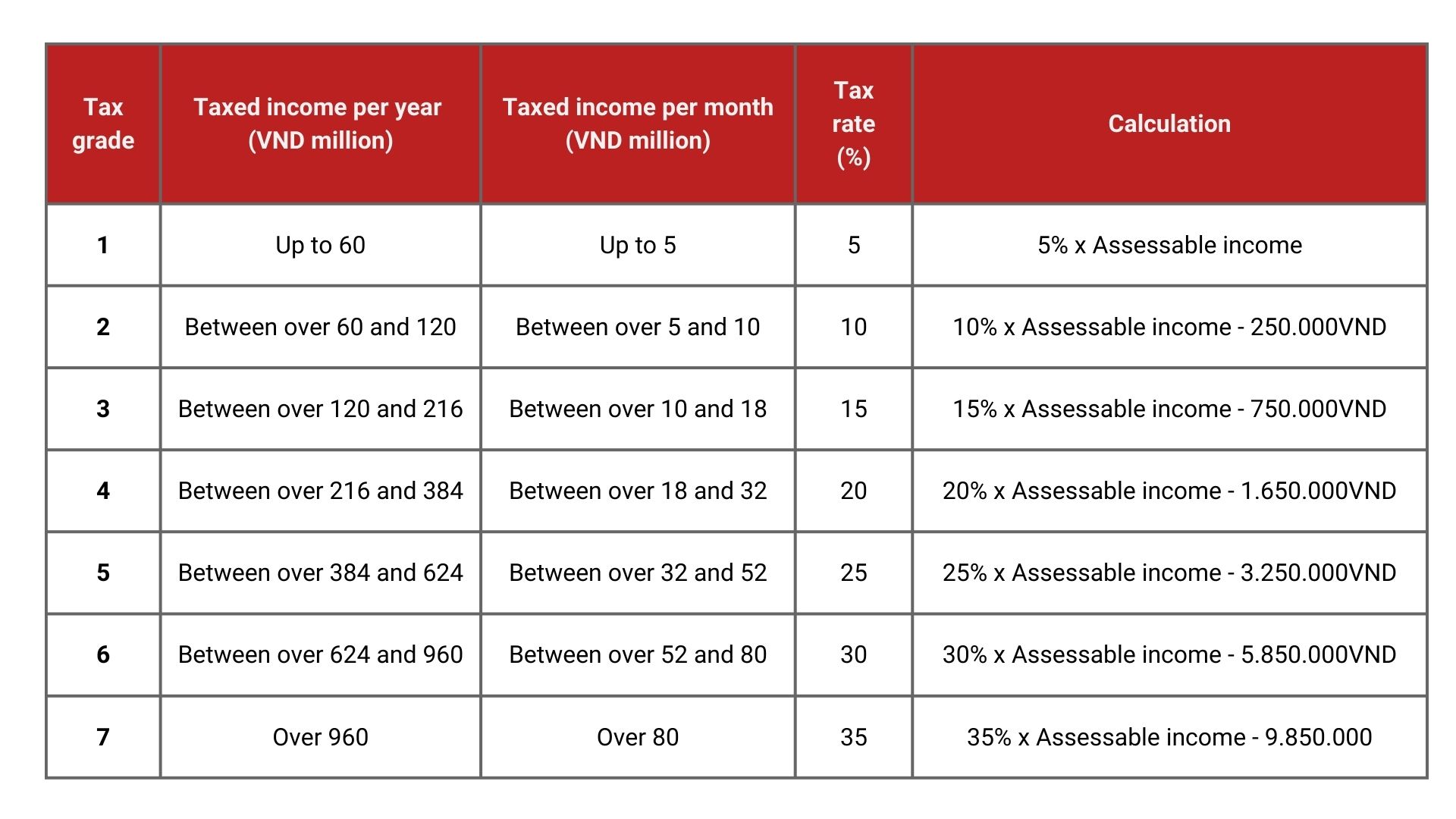

The tax system in Vietnam depends on the number of days you spend in the country. If you stay in Vietnam for more than 183 days in a calendar year, you are considered a tax resident. As a tax resident, you pay Personal Income Tax (PIT) at progressive rates ranging from 5% to 35%, similar to Vietnamese citizens. On the other hand, if you stay 183 days or fewer, you are instead treated as a non-resident and taxed at a flat rate of 20% on your Vietnam-sourced income.

Note: PIT liability can start from Day 1 of performing work related to Vietnam, even if you are not physically in the country. This applies to Short-term expatriates and business travelers performing work related to Vietnam.

The tax rates depend on your income level which can range from 5% to 35%. The tax year starts from 1st December to 31st December which requires monthly income tax filings and annual returns due by March 30th. How your taxable income is determined will depend on the time you spent working in Vietnam, or the proportion of total annual income corresponding to Vietnam workdays:

| If Not Present in Vietnam | If Present in Vietnam |

| Taxed based on the proportion of total annual work days allocated to Vietnam-related work. | Taxed based on days physically present in Vietnam over a 365-day period |

If you are employed at a job, your employer will be the one handling your monthly income tax payment. Meanwhile, if you are self-employed you need to manage your tax payments by yourself through bank transfers. In such cases, hiring an accountant is a good idea to assist expats with their annual tax payments.

Read More: Personal Income Tax (PIT) for Foreigners in Vietnam: Your Simplified Guide to Compliance and Savings

Company & Individual Responsibilities

Companies have a withholding obligation if they make any payments to the individual, and they must also report essential details of foreign employees under service contracts – such as names, nationalities, passport numbers, working duration, positions, and incomes – to the tax authority.

Meanwhile, individuals are required to file their own tax returns directly with the tax office for any income not paid or covered by a Vietnam-based company.

Immigrant, Work Permit, and Service Contract Requirements

In addition to tax responsibilities, immigration and work permit requirements also come into play. Short-term travelers may enter Vietnam under visa exemptions, e-visas, or business visas. They are also exempt from work permit requirements if each trip lasts less than 30 days and the total number of trips does not exceed three per year.

However, exceeding these limits means they will need a work permit. To ensure full compliance, the service contract must clearly define the tax obligations for foreign employees working in Vietnam.

Social Security and Insurance Requirements

It is compulsory for all foreigners who are working in Vietnam to contribute to the social security system. This includes a 17.5% contribution for social insurance, 3% for health insurance, and 2% for trade union fees. These payments are necessary to ensure your security in Vietnam and you can avail of other benefits and services as well.

Healthcare System and Insurance

Vietnam’s healthcare system follows public and private models but is gradually moving more towards a complete public system. There is a strong emphasis on preventative care which is effective in handling public health challenges. Expats prefer private hospitals in major cities like Hanoi and HCMC. The medical staff in these facilities are generally English or French-speaking, trained to provide premium care. All these facilities make private health insurance a recommended choice for expats especially those who are living outside urban centers.

You can also consider adding medical evacuation coverage to your insurance plan, as some treatments might require you to travel to different locations like Thailand, Singapore, or South Korea. Also, remember that European health cards (GHIC or EHIC) are valid in Vietnam, which is why you need local or international coverage.

Read More: Understanding Vietnam Social Insurance: Social, Health & Unemployment Insurance (SHUI) for Employees

Some Recommended Cities for Living in Vietnam

Vietnam has many cities well-suited for a leisurely life. While searching for places in Vietnam, people think of various factors like cost of living, lifestyle, and whether other people like them are living there or not. Here are some places which you can consider to live in Vietnam:

Hanoi

Hanoi is the capital of Vietnam in the north. If you want to experience the real Vietnamese culture, Hanoi is the best place for you. At first, you might be surprised by the busy life and the streets but in Hanoi, there is always something fun to do. Many foreigners live here as the living costs are low. That’s not all, as the icing on the cake is that you can go on short trips to nearby places like Sapa and Ha Long Bay.

Danang

Danang is a lively city, well-loved by both locals and tourists. You can enjoy golden beaches and viridescent mountains, this city has everything for you to enjoy. The surprising fact about this city is that even though it is the third largest city in Vietnam with over a million people living there, you will not find busy streets like other big cities, and everything else on the table in the third largest city in Vietnam, with over a million in population. Yet, surprisingly, its streets are quite idle compared to the other major cities.

It is a friendly place where people are always ready to help. Near Danang, there is a beautiful small town, Hoi An. It is a 30-minute skip and dash away from Danang. This place is so special that it is protected as a world treasure by UNESCO.

HCMC

Considered the biggest city in Vietnam, Ho Chi Minh City, also known as Saigon, is divided into 12 different areas, each with its own places to eat, have fun, and live. The city possesses a more contemporary infrastructure, with tall buildings, shops, and bars on the top of the buildings. The mixture between modern and traditional cultures has made HCMC one of the best places to explore in Vietnam.

Cost of Living in Vietnam for Expat

Vietnam is a great option for expats who want to stretch their budgets further than in the UK. It is possible that your expenses could be a third of what they were back home for everyday necessities. How far your money goes is really dependent on you and the city you live in.

If you plan on driving in Vietnam, you will want to read this. You cannot rent a car or bring a car into the country as you need a Vietnamese driving license for that. However, you can own a motorcycle, and many expats get around the country that way. In fact, it is a great way to get around and many locals wave you by with big smiles on their faces. It is a great way to experience the real Vietnam.

Moving to Vietnam is also a straightforward process. The country has many ports so finding one near your new home is easy. Once you have booked your shipping you will need to move your goods to your new home.

For most people, moving to Vietnam is under US$3,000, and many people spend less than US$1,000. It all depends on where you are moving from and how much you choose to bring, and the lifestyle you prefer to have.

Here is the cost of living in Hanoi or Ho Chi Minh City for 1 person:

| Expense | Cost (US$) |

| Accommodation | US$400 |

| Utilities | US$50 |

| Food (local) | US$200 |

| Food (local and international) | US$300 |

| Transport | US$55 |

| Phone | US$5 |

| Miscellaneous | US$45 |

| Total | US$955 – 1000 |

Pros and Cons of Living in Vietnam Permanently

Pros

- Affordable cost of living: Living in Vietnam is affordable and you can bargain for your desired stuff as well. If you work as an expat, your salary will be enough to live a comfortable life.

- Easy to get around: Vietnam has many airports, which makes it easy to travel around the country to nearby places like Singapore or Thailand. You can use a taxi, train, etc., for daily commute.

- Great for English speakers looking for work: There are many schools that look for teachers who teach English. There are plenty of jobs available for them and it is the most common work for expats in Vietnam.

- Amazing food: You can experience the fabled Vietnamese cuisine, known for its amazing taste and affordability. You can try local dishes while having a great time with friends.

- Nice weather: The weather in Vietnam is nice and pleasant. The rainy season, with accompanying storms, is a common sight. The chances of major natural disasters are negligible in this country.

Cons

- Tourist pricing: The pricing for tourists is high when compared to locals for the same things. You should always check the prices before paying for anything.

- Busy and polluted cities: While some cities are peaceful, other are jam-packed with countless motorbikes on the road. There might be problems related to air quality as well.

- Paperwork headaches: The paperwork, including documents like a visa or work permit, can make one feel like a hamster on a wheel. This is why people often hire local agencies to help smoothen the process.

- Different way of life: You might find the local customs strange in Vietnam. People observe old traditions which can be hard to grasp at first. It may take some time to get used to things.

- Weather changes a lot: The North has very different weather from the South. Up North, you might see snow in winter and very hot summers (over 40°C), while the South stays warm all year. You need to be ready for whichever region you choose.

Read More: How Overseas Vietnamese Can Register for Permanent Residence in Vietnam?

Expats Living in Vietnam: 10 Essential Laws and Insights Must Know

With its beautiful scenery and tropical lifestyle, it’s no surprise that Vietnam is an attractive destination for many expats. However, as an expat living in Vietnam, you should be aware that expats life here is quite different from other popular regions due to Vietnam’s unique political structure, geographical location, economic framework, social norms, and quality of life.

Invest in Vietnam? Check out InCorp Vietnam’s Immigration Services in Vietnam

What many expats may not realize is that Vietnam’s laws can differ significantly from those in other countries. While some rules might seem too stringent, and locals may occasionally overlook them, it’s essential to understand what is acceptable and what isn’t. Failing to do so could result in serious consequences, including imprisonment.

Expats who consider moving to Vietnam or currently live there, check out the following laws to enjoy your stay in Vietnam and do not put yourself at any risk.

1. Drugs

Vietnam maintains a zero-tolerance policy towards drugs, with severe penalties enforced under Decree 60/2020 ND-CP. Possession of heroin can lead to the death penalty, while drug trafficking results in lengthy prison sentences. Recent statistics indicate that drug-related offenses remain a significant concern, prompting ongoing government crackdowns. Law enforcement has been actively cracking down on drug trafficking, resulting in the seizure of over 542 kg of drugs through various operations along its borders.

2. Work Permit

Even though starting a company in Vietnam isn’t overly difficult, expats will quickly notice the obvious bureaucracy. You’ll need permits for almost every aspect of running a business, and for expats, working or starting a business without a work permit is illegal.

According to Article 22, Decree No. 95/2013/ND-CP, expats who work without permits will be deported immediately; and for their employers, the fine can be up to VND 75 million with the possibility of their operations being suspended from 1 to 3 months.

Read Related: Work Permit in Vietnam: Requirements, Procedures, and Agency Services for Your Vietnam Work Visa

4. Visa

Visa requirements can be particularly complicated for expats. It’s essential to understand them, apply for and hold the correct visa, and stay updated with immigration officials on the latest information. More often than not, the visa application process for expats, especially for long-term stays and residency in Vietnam, involves significant bureaucracy, extensive paperwork, and long delays.

Read Related: Guide to Vietnam Visas: Types, Application Procedures and Cost for Foreign Investors

However, do not be discouraged. Apply well in advance, consult a visa agent in Vietnam, and be patient. In any case, make sure that you do not violate visa conditions by working without a work permit or overstaying a tourist visa.

Vietnam offers various entry visas with different symbols and validity periods. Five common visa types include:

- Symbol ĐT (Investor Visa): Valid for 1 to 10 years, issued to foreign investors.

- Symbol LĐ (Work Visa): Valid for up to 2 years, issued to foreign workers.

- Symbol DN (Business Visa): Valid for up to 1 year, issued to those working with companies in Vietnam.

- Symbol TT (Dependent Visa): Valid for up to 1 year, issued to parents, spouses, and children under 18 of foreigners holding ĐT, LĐ, or DN visas.

- Symbol DL (Tourist Visa): Issued to tourists.

Read Related: Can You Renew Your Work Visa in Vietnam?

Download the full PDF guide for the Vietnam Visa Guide now!

5. Nudity

Don’t be surprised that, despite the abundance of beaches, there are no nude beaches in Vietnam. While locals are generally tolerant of revealing clothing in tourist areas, the culture remains relatively conservative.

Public nudity is not acceptable, so it’s best to avoid anything that could be considered offensive or get you into trouble. Keep in mind that such behavior is only appropriate in the privacy of your own space.

6. Buy a Property, Not Land

As a foreigner living in Vietnam, you may purchase property or houses in the country. However, if you have ever thought of buying land and building your dream house on it, it is almost impossible. According to Land Law No. 45/2013/QH13 dated November 29, 2013, lands are assets that belong to the country, so you can only buy the structure built on the land, but not the land itself.

In other words, the house belongs to you, but the land that the house is on does not, according to

As the owner of the property, you can enjoy the right to use the land for up to 50 years in the form of a land lease. The lease can be renewed without the rent being increased. The property is yours indefinitely as long as you lease the land.

Read Related: Property in Vietnam: 7 Key Insights for Foreign Investors to Thrive

7. Capital Required to Start a Business

Apart from the start-up capital, in order to get a license and start a business in Vietnam, there are no other financial requirements. However, it is highly recommended to have at least US$25,000 in your bank.

Read More: An Extensive Guide to Industry Capital & Deposit Requirements in Vietnam

8. Register Yourself with the Authority

As an expat, once you have moved into a residence, you need to register yourself with the local police. If you are a foreign tourist, your hotel or accommodation will do this on your behalf. The reason for registering yourself is that the police know you live in that place and you will be held accountable for any violation of regulations.

9. Exporting Antique

It is not new that you cannot bring any antique home from Vietnam. All antiques and cultural artifacts will need approval from the Ministry of Culture in Vietnam before they can even leave the country. No matter how much you love an antique you have seen somewhere in Vietnam, it is illegal, and no way for you to export antiques from Vietnam without a permit.

10. Protected Species Trade

Vietnam is a member of the Convention on International Trade in Endangered Species of Wild Fauna and Flora. The government is trying its best to stop the illegal trade and prevent it from threatening the biological heritage of Vietnam and Southeast Asia. As a result, you will face a long jail time of up to 12 years and a fine of up to VND 1.5 billion if found guilty of hunting or trading endangered or protected species.

How InCorp Vietnam Can Assist?

Applying for a work permit and residence card in Vietnam can be a complex and time-consuming process, especially if you are unfamiliar with local regulations. Since employment and residency status are time-sensitive, working with a local expert or legal consultant ensures a smooth and successful application process, allowing you to work and stay in Vietnam hassle-free.

InCorp Vietnam provides comprehensive permit and visa services, along with a full suite of corporate business solutions to help you stay compliant, streamline operations, and reduce costs. With years of expertise, we have assisted thousands of individuals and businesses worldwide in establishing themselves in Vietnam and achieving long-term success.

Check out Our InCorp Vietnam’s Work Permit & Temporary Residence Card (TRC) Services

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Can Foreigners Live In Vietnam

- Yes, foreigners can live in Vietnam by obtaining the appropriate visa or residence permit. Long-term stays typically require a work, investor, or family visa.

How Much Does It Cost To Live In Vietnam

- The cost of living in Vietnam is relatively low, with monthly expenses ranging from $700 to $1,200 for a single person, depending on lifestyle and location. Major cities like Ho Chi Minh City and Hanoi tend to be more expensive than rural areas.