As of July 2023, Vietnam witnessed an increased number of new businesses (13.7 thousand) registering in the country, taking the registered capital of doing business to nearly VND 127 trillion. This is a 2.4% rise in registered capital and a 4.3% rise in the number of businesses registered as compared to the same period in the previous year. This shows that despite the ease of doing business in the country being one of the most demanding in the world (as per the World Bank), many foreign entrepreneurs are willing to set up companies in Vietnam. To operate efficiently and stay compliant, it is recommended to use finance and accounting outsourcing services that help businesses manage their financial and regulatory requirements effectively.

Tax obligations form an essential part of doing business anywhere in the world, especially in Vietnam, where errors in tax filing can lead to severe legal consequences that can harm you financially. In this article, we have provided detailed information regarding corporate tax in Vietnam, ensuring you understand how to use the Vietnam tax calculator to file your taxes while doing business in the country.

Some Basic Tax Types and Vietnam Tax Calculator

All companies, irrespective of their business size and nature, have to follow the tax code in Vietnam. However, most businesses struggle to comply with the complex tax structure set by the Vietnamese government and take the help of consultants who can act as a Vietnam tax calculator, guiding you through the various taxes, including:

The Corporate Income Tax (CIT) payable by different companies

This is a flat 20% corporate tax in Vietnam, which every company must pay. Additionally, businesses in certain industries or locations get tax deductions based on the conditions of the projects. However, in some cases, it can be high, like when companies exploring and extracting petroleum have to pay 32-50% CIT, precious metals and minerals mining companies are subjected to 50% CIT and if 70% of your business area lies in difficult socio-economic conditions, CIT reduces to 40%.

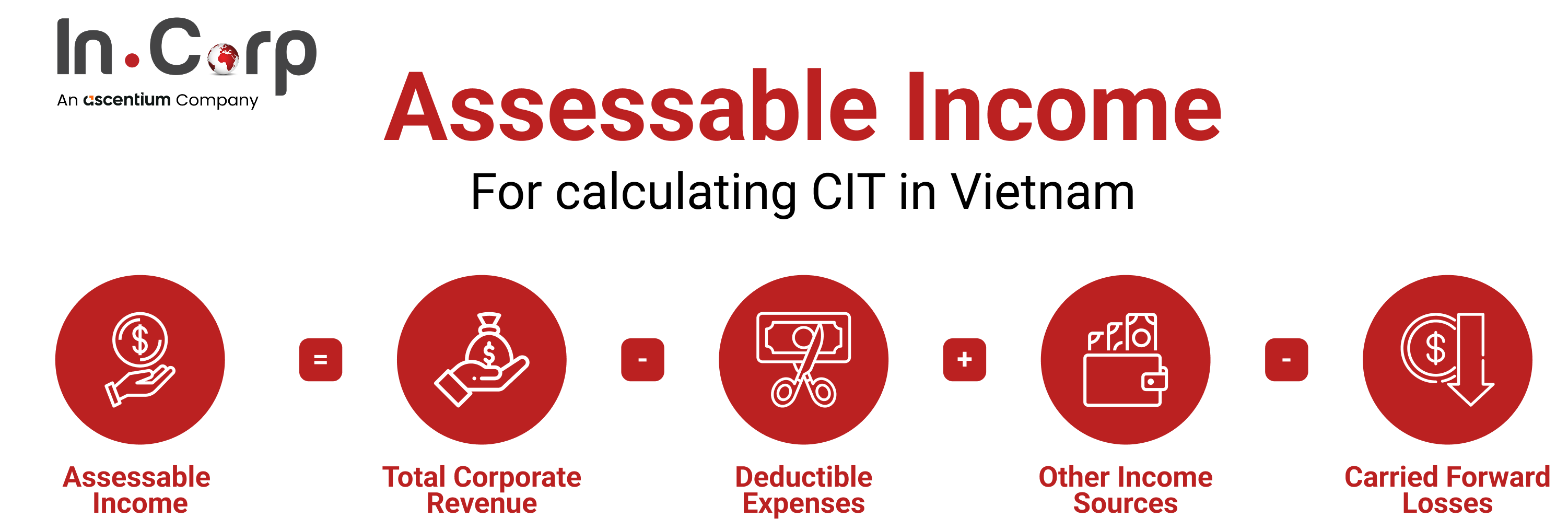

Using the following method in the Vietnam Tax Calculator helps in the accurate calculation of CIT.

CIT Payable in the period = Assessable Income × CIT rate

Where assessable income is:

Read More: Setup & Plan Your Corporate Income Tax Vietnam: Everything You Need to Know about CIT

However, if you are part of healthcare, high-tech companies, software development, education, infrastructure, environmental protection, aquatic and agricultural product processing, and renewable energy, you get certain deductions.

The Value-Added Tax (VAT) payable by anyone using goods and services

VAT in Vietnam is an indirect sales tax on products and services, where businesses collect it from customers and pay it to the government. The VAT rate depends on the type of products or services and the business sector. Companies must also pay VAT on imported goods or services and should register for VAT once they obtain business permits.

The standard VAT rate is 10%, but certain goods and services benefit from a reduced rate of 5%. Exported goods and services are subject to 0% VAT, while a separate list of VAT-exempt items includes products that support agriculture and essential services for citizens. Exempt goods have no VAT obligations.

Here’s a list of goods and their VAT rate:

Companies in Vietnam can either use the direct method of VAT calculation and declare it in 2 days, or they can use the default indirect method used by most businesses to calculate the gap between VAT output and input. The direct method is only applicable to micro-enterprises and household businesses. You are eligible to get a VAT refund if the VAT input is not subtracted after 12 months or 4 consecutive quarters and the deductible VAT amount carried forward exceeds VND 300 million.

Read More: Value-Added Tax in Vietnam: Guide to Navigating VAT for Business Success

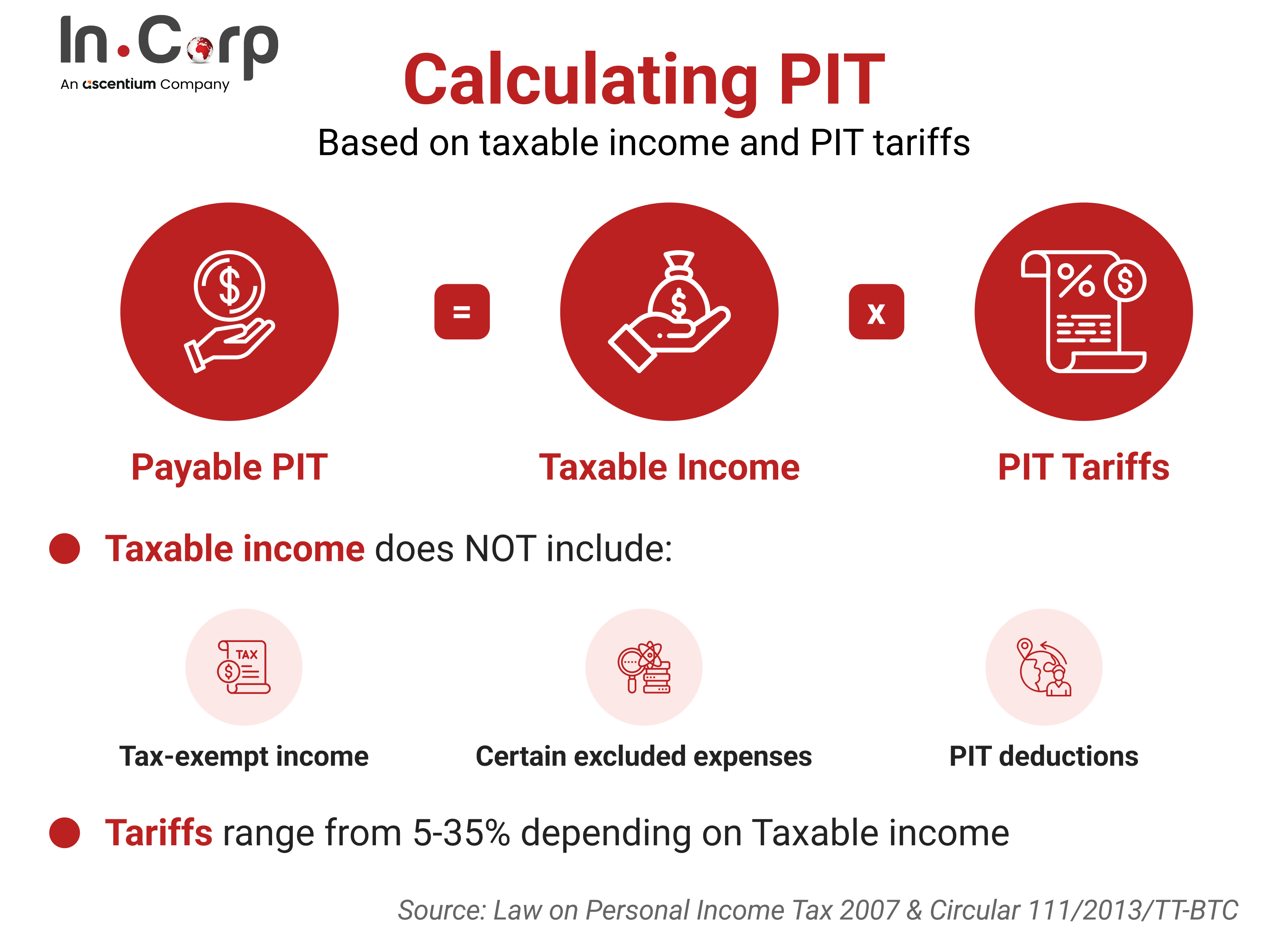

The Personal Income Tax (PIT) payable by members and employees of companies

Personal income tax (PIT) in Vietnam applies to individuals earning income and is based on salary, allowances, and other earnings. Employers withhold PIT from employees’ salaries and remit it to the government monthly or quarterly.

If the monthly PIT exceeds VND 50 million, it must be declared monthly; otherwise, it can be declared quarterly. PIT rates vary by income type, starting at 5% for annual incomes under VND 60 million and increasing to 35% for incomes above VND 960 million.

Read More: Personal Income Tax (PIT) for Foreigners in Vietnam: Guide to Compliance and Savings

Business License Tax payable by companies to get licenses for their daily operations.

This tax is paid annually by businesses based on their charter capital as recorded on their business license. It typically reflects the revenue or added value generated in the previous year. Companies established after February 25, 2020, are exempt from paying the license tax in their first year of operation, as well as any branches opened during that period. After the first year, the annual license fee is VND 1 billion.

If a company was established before February 25, 2020, and opens a branch after that date, the branch must pay license fees as per Decree No. 139/2016/ND-CP. Branches set up in the first six months of the year must pay the full year’s fee, while those established in the last six months pay 50%.

Foreign-owned companies, once incorporated in Vietnam, are treated as tax residents and must comply with all local tax obligations. Failure to meet these regulations can result in business suspension or, in severe cases, liquidation and dissolution.

Read Related: Foreign Contractor Tax in Vietnam: FCT Vietnam Calculation and Completing Foreign Contractor Tax Form

Tax Code in Vietnam: Registration Process

To file for taxes, every Vietnamese company must get a tax registration number, which is regarded as the tax code in Vietnam. The tax code is often used as a business license number or Enterprise Identification Number (EID), as you need this to do any financial operations. Companies can easily receive the tax code for Vietnam once they submit the company registration application form along with the necessary documents.

When are Taxes Due in Vietnam?

The taxation in Vietnam for expats or foreign companies is due on a monthly, quarterly, or annual basis, depending on the revenue generated by the company. Companies with FDI need to submit independent audit reports as per the country’s tax compliance calendar.

FDI-audited companies should submit the annual financial report to the tax authorities within 30 days of the next fiscal year, while annual FDI reports should be filed by March 31 every year. Companies also need to file quarterly FDI reports within 10 days of the end of the quarter.

Companies must file the yearly Occupational Safety & Hygiene report and the unemployment insurance report by January 10 and January 15, respectively. The financial report to the statistics department should be submitted within 30 days of the end of the fiscal year.

For the first 6 months of the year, companies have to submit the employment and labor use report by June 5, while the whole year’s report should be filed by December 5. The bi-annual foreign employment and labor accident reports are submitted on July 5 (for the first 6 months) and January 5 (for the entire year).

Download the Infographic: Guide to Taxation & Compliance Deadlines in Vietnam

If the annual turnover of the business doesn’t exceed VND 50 billion in the previous year, then they can file quarterly VAT declarations by the end of the first month of the following quarter. However, for others, a monthly VAT declaration has to be filed by the 20th of the next month.

In the case of corporate tax in Vietnam, the CIT can be filed within 30 days after each quarter’s report. However, you also need to remit any payable corporate income tax balance within 90 days of each financial year for annual CIT returns.

A standard financial year in Vietnam runs from January 1 to December 31. However, companies can design their own financial year ending on March 31, June 30 or September 30 as per their business activities. This is required to pay the annual business license fee, which can be paid either by the first 30 days of the next calendar year or within 20 days of the next fiscal year.

Need Help with Vietnam Tax Calculator and Corporate Tax? Read About InCorp Vietnam’s Accounting Outsourcing Services in Vietnam

Tax Finalization, Payment, and Report

For all companies and individuals, the deadline for tax compliance is fixed within 90 days of the fiscal year end, which is March 31 of the following year. Most businesses go by the Gregorian calendar, which begins in January and ends in December, as it aligns with the standard Vietnamese tax year. However, you have to intimidate the tax authorities if you are following your own fiscal year, which differs from the calendar, like some Australian companies follow a July to June calendar year.

Companies should mark the following tax finalization dates in their calendar

- VAT Finalization: Due 60 days from the end of the fiscal year

- PIT Finalization: Due the 31st of March of the following year

- CIT Finalization: Due the 31st of March of the following year

In the case of monthly, quarterly, and annual tax payments and report submissions, remember the following dates:

- On the 20th of each month: VAT & PIT declaration of the previous month

- On the 30th of the starting month in each quarter: Tax payment for CIT for the previous quarter and invoice reports

- On the last day of March of each year: PIT & CIT finalization of the previous year; financial statement of the previous year; audit report for the FDI company.

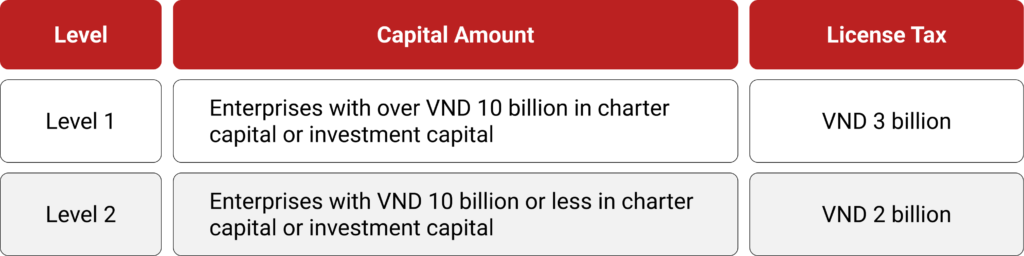

Foreign companies must follow the three levels of business license tax for compliance.

- Companies with VND 10 billion of registered chartered capital (US$430,000) or less should pay VND 2 million (US$85) annually.

- Companies with more than VND 10 billion in registered chartered capital (US$430,000) should pay VND 3 million (US$130) annually.

- Representative offices, branches, public service providers, business locations, and other business organizations should pay VND 1 million (US$40) annually.

Businesses set up in 2023 are exempt from paying the business license tax for the first year of operations as per Circular No. 81/2021/TT-BTC, although they have to file a declaration. However, branches of parent companies registered before 24/02/2020 are not exempted.

Failing to report these taxes in time can lead to severe penalties based on the days they are overdue. The fine can be millions of VND or a simple warning letter, depending on the gravity of the offense. Business licenses can be repelled, and fines pile up in cases of repeated offenses.

Read Related: VAT Refunds for Companies in Vietnam

Tax Outsourcing with InCorp Vietnam for 100% Compliance

From the above discussion, it is clear that proper accounting and recording of your daily financial transactions are crucial for tax compliance in Vietnam. However, many companies fail to navigate the corporate tax system in Vietnam, as it involves a complex set of taxes and deadlines. With the financial taxation experts at InCorp Vietnam, you can bypass these time-consuming tasks as you entrust us with the Vietnam tax calculator role. We support foreign companies with tax outsourcing solutions that ensure 100% tax compliance with Vietnamese laws.

Get in touch with our tax specialists and book a free consultation if you are looking for a reliable tax outsourcing service provider in Vietnam.

A Guide to Corporate Taxes and Compliance Work in Vietnam

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Does Vietnam Have Taxes

- Yes, Vietnam has a tax system that includes personal income tax, corporate income tax, value-added tax (VAT), and other taxes. The system is administered by the General Department of Taxation under the Ministry of Finance.

How Much Tax Do You Pay In Vietnam

- In Vietnam, personal income tax rates range from 5% to 35% for residents, depending on income level. Non-residents are generally taxed at a flat rate of 20% on income earned in Vietnam. Corporate income tax is typically 20%.

What do we mean by corporate?

- "Corporate" generally refers to anything related to a corporation, which is a legal entity separate from its owners. In business, it typically describes structures, activities, or attributes associated with companies, especially those that are formally incorporated under law (e.g., limited liability companies or joint-stock companies).

What is a corporate company?

- A corporate company is a legal entity that is separate from its owners and is typically formed to conduct business activities. It has its own legal rights, can own property, enter contracts, sue or be sued, and is subject to corporate governance and taxation. In Vietnam, corporate companies are often established as a Joint Stock Company (JSC) or a Limited Liability Company (LLC). These structures limit the liability of shareholders or members to the extent of their capital contributions.