Vietnam’s tax system encompasses a range of direct and indirect taxes that apply to businesses of all sizes. For small and medium-sized enterprises (SMEs), the key taxes include corporate income tax (CIT), value-added tax (VAT), personal income tax (PIT), foreign contractor withholding tax (FCWT), and the business license tax (BLT). Each tax has its own rates, filing requirements, and deadlines. For example, Vietnam’s standard CIT rate is 20% for most businesses, while VAT is levied at 10% (temporarily reduced to 8% in most sectors through 2026). Personal income tax for residents is progressive from 5% up to 35%, whereas non-residents pay a flat 20% on Vietnam-sourced income.

In addition, SMEs must pay an annual business license tax (typically VND 1–3 million) based on capital and with very favorable exemptions for new enterprises. Compliance is enforced by strict deadlines: for instance, VAT returns are due monthly (by the 20th of the next month) or quarterly (by the 30th of the next quarter), and the final CIT return is due by March 31 of the following year. This article provides a structured overview of Vietnam’s tax system as it affects SMEs, including major tax types, filing obligations, incentives, and penalties.

Discover how our Accounting & Bookkeeping Services help SMEs and FDIs stay compliant while reducing costs.

Corporate Income Tax (CIT)

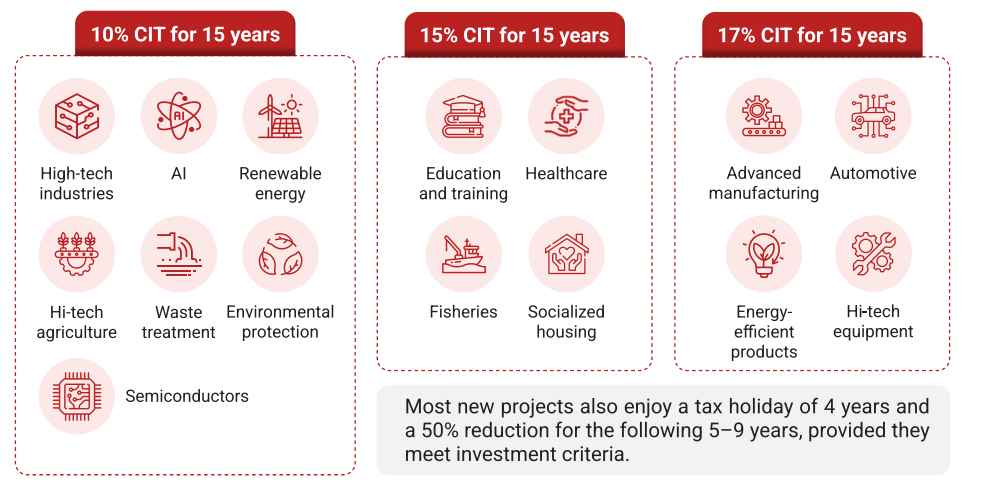

Corporate Income Tax is a direct tax on company profits. In Vietnam’s tax system, the standard CIT rate is 20% for most enterprises. This rate applies to gross revenue minus allowable expenses. Certain priority industries enjoy lower rates (for example, 10–17% for high-tech or education projects), while extractive industries may face higher rates (32–50%). Profits subject to CIT include business earnings, capital gains, and other income streams. SMEs should track deductible expenses carefully: ordinary business costs such as salaries, raw materials, and depreciation are deductible. However, Vietnam’s tax laws disallow deductions for excessive interest, unsubstantiated payments, fines, or inflated related-party transactions. Losses can generally be carried forward (up to 5 years) to offset future profits.

Filing and payment: Companies must make provisional CIT payments quarterly, based on actual or estimated profits. Each quarter’s tax is paid by the 30th day of the following quarter. Over the year, at least 80% of the total annual CIT liability should be covered by these payments. If the total falls below 80%, interest penalties accrue from the Q4 deadline. The final CIT return is filed after year-end: the deadline is the last day of the third month following the fiscal year (typically March 31). At that time the company submits audited financial statements and declares its final tax due. Any remaining tax payment is made with the final return.

Incentives and deductions: Vietnam’s tax system offers various CIT incentives to encourage investment and formalization. Under the new 2025 CIT law, SMEs benefit from graduated tax rates: micro-enterprises (annual revenue ≤3 billion VND) pay 15% CIT, and small enterprises (3–50 billion VND revenue) pay 17%. Only larger firms pay the standard 20% rate. This tiered structure directly reduces tax burdens for startups and smaller companies.

Moreover, newly incorporated micro/small enterprises that convert from household businesses receive a 2-year CIT exemption (tax holiday) from their first profit-making year. SMEs in designated high-tech or disadvantaged zones may also qualify for CIT holidays or reduced rates (for example, full exemption for 2–4 years followed by 50% reduction). In addition, qualifying R&D and innovation project income can be exempt for up to three years under recent reforms. Standard tax deductions include reasonable business expenses: notably, the tax law now allows broader R&D and innovation expenses to be deducted, and pre-operating costs may be amortized over up to three years.

Learn how we’re guiding clients through changes in tax laws in our article “A Complete Guide to Draft Corporate Income Tax Law in Vietnam.”

Value-Added Tax (VAT)

Vietnam’s VAT is a multi-stage consumption tax applied at each production or distribution step. The standard VAT rate is 10%, but under recent stimulus measures it is temporarily cut by 2 percentage points (to 8% for most goods and services through December 2026). A reduced rate of 5% applies to essentials (e.g. clean water, medical equipment, certain agricultural inputs), and a 0% rate is used for exports, international transport, and other special activities. VAT-exempt sectors include healthcare, education, most financial services, and public transport.

Unlike exempt sales, which generate no VAT credit, standard-rated transactions allow businesses to claim input VAT credits against output VAT. For example, an SME can deduct the VAT paid on raw materials if it has proper invoices, which avoids double taxation.

Thresholds and exemptions: Small businesses and household traders have special rules. Under the new VAT law, individual and household businesses with annual revenue ≤200 million VND are exempt from VAT starting in 2026 (doubled from the old 100 million VND threshold). Below this threshold they do not register for VAT. Also, foreign contractors supplying goods or services in Vietnam may be subject to withholding tax in lieu of VAT (see FCWT below).

Filing and payment: Most companies file VAT returns either monthly or quarterly. Firms whose revenue exceeds the government threshold must file monthly; others may file quarterly. Monthly VAT returns and payments are due by the 20th day of the following month, while quarterly returns are due by the 30th day of the month after the quarter ends. For instance, a January VAT return is due February 20, whereas Q1 VAT (Jan–Mar) is due April 30. VAT is paid at the same time the return is filed.

Refunds and incentives: Exporters can apply for VAT refunds on accumulated input VAT credits, subject to meeting documentary requirements. The tax system allows VAT refunds for investment projects once input VAT reaches specified amounts. However, certain non-cash payment and documentation requirements were tightened: expenses over 5 million VND require non-cash payment to be deductible. Additionally, the temporary 2% VAT reduction through 2026 helps reduce VAT costs for businesses.

Personal Income Tax (PIT)

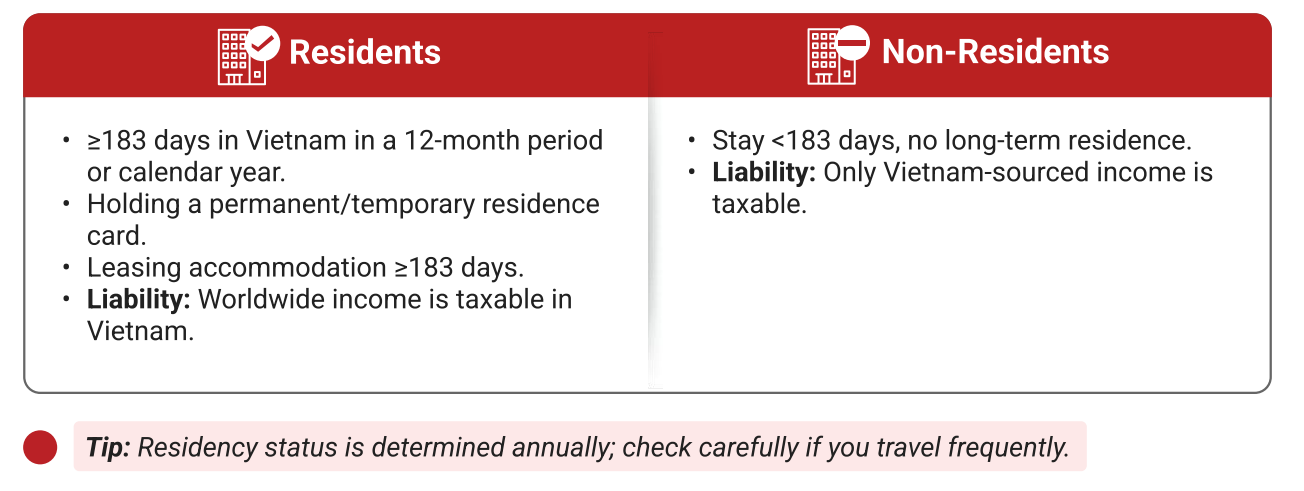

PIT is levied on individuals’ earnings. In Vietnam’s tax system, tax residents (those living in Vietnam ≥183 days in a year or with a permanent home) pay tax on worldwide income; non-residents pay 20% on Vietnam-sourced employment income. Resident salaries and wages are taxed at progressive rates from 5% up to 35%. Employers withhold monthly PIT from salaries, and employees can claim allowances (11 million VND per month for themselves and 4.4 million per dependent) to reduce taxable income.

SME owners and household business: If an SME owner operates as a household business (unincorporated), business revenue is subject to PIT under a presumptive basis. As of 2026, very small ho usehold businesses with revenue under 200 million VND per year will be exempt from PIT, reducing tax for micro-entrepreneurs. Once such businesses incorporate, their profits are taxed as corporate income instead. Owners who take salaries or dividends will pay PIT on those receipts as well.

Filing deadlines: Employers file PIT monthly (by the 20th) or quarterly (by end of quarter) withholding declarations and pay quarterly by April 30, July 31, etc. Companies must finalize PIT on behalf of employees by the last day of March following year-end. Individuals who self-file have until the last day of the fourth month (April 30, or May 31 in 2025 due to holidays).

Foreign Contractor Withholding Tax (FCWT)

Foreign Contractor Withholding Tax (often called “FCT” or FCWT) is a special withholding regime. It applies when a foreign company (or individual) provides goods, services, or contracts in Vietnam without establishing a permanent local entity. Essentially, FCWT combines Vietnam VAT plus either CIT or PIT on payments to the foreign party. For example, a foreign supplier selling goods via a Vietnamese agent will have 0.5% or 1% VAT (depending on the transaction) and 1–10% CIT withheld by the Vietnamese buyer, or 5% PIT if the contractor is an individual.

Under the direct method, the Vietnamese client withholds and remits the tax to the authorities. Net and gross contract rules determine whether the VAT/CIT is calculated on the invoice amount or added on top. In either case, the Vietnamese payer must declare and pay FCWT within 10 days of making payment to the foreign contractor. (If multiple payments occur, a consolidated monthly return by the 20th may be allowed.) This ensures foreign suppliers pay tax roughly equivalent to Vietnamese businesses under the normal tax system.

Business License Tax (BLT)

The Business License Tax is an annual tax on the right to do business. It is calculated based on a company’s registered capital and is due each year, regardless of income. Rates are flat for each bracket of capital. In practice, all enterprises (including new or small firms) pay BLT, but the amount is modest: typically 1–3 million VND per year for most companies.

Payment is due by January 30 each year for the past tax year. Notably, Vietnam provides generous BLT exemptions to SMEs: newly established companies and first-time household businesses owe no license tax in their first year. Furthermore, SMEs that convert from household businesses enjoy a three-year BLT exemption. If a business is temporarily suspended (with notice to tax authorities by Jan 30), BLT for that year is also waived. Otherwise, failure to pay BLT (or declare any change in capital) by the deadline incurs fines and interest.

Other Taxes

Vietnam’s tax system also includes specialized taxes, though these may be less relevant for most SMEs. Special Consumption Tax (SCT) (excise) applies to luxury goods and certain services (tobacco, alcohol, automobiles, gaming, etc.) at varying rates. Environmental Protection Tax applies to goods like petroleum products, chemicals, and plastic bags. Natural Resource Tax is levied on extraction of resources (for firms in mining or forestry). Importers/exporters must also pay customs duties on goods brought across Vietnam’s borders. Additionally, all businesses must comply with social insurance and health insurance contributions for employees, which are separate statutory contributions rather than taxes. SMEs should identify any industry-specific levies that apply to their operations.

Tax Residency Rules

Vietnam determines tax residency for individuals based on presence. Anyone in Vietnam for 183 days or more (in a 12-month period) is a tax resident and is taxed on worldwide salary income. Residents use the progressive PIT rates mentioned above. Non-resident foreigners pay flat 20% PIT on Vietnam-sourced salary and service income.

For corporate income, a foreign company with a Vietnamese permanent establishment (PE) or fixed place of business is treated similarly to a local company: it pays CIT on profits attributable to the PE. Under recent law, many foreign digital/e-commerce providers are deemed to have PE and may owe tax even without a local office. Double tax treaties can mitigate double taxation, but SME owners should register properly and determine residency to understand their tax obligations.

Filing and Payment Obligations

SMEs must file and pay taxes on a monthly, quarterly, and annual basis according to thresholds and tax type. Key deadlines include:

- VAT returns: File monthly (revenue above threshold) by the 20th of next month or quarterly by the 30th after quarter.

- CIT filings: Provisional payments each quarter by the 30th day of the next quarter. The final annual CIT return (with financial statements) is due by March 31 (last day of third month after year-end).

- PIT filings: Employers withhold and declare PIT monthly or quarterly along with social contributions. The annual PIT finalization for a company’s employees is due by March 31 of the following year; individual self-filers (contractors or those with multiple incomes) must finalize by April 30 (or early May, accounting for holidays).

- BLT payment: Annually by January 30 for the prior year.

- FCWT: Withhold and remit within 10 days of each payment to a foreign contractor.

All tax filings in Vietnam are now submitted electronically through the General Department of Taxation’s eTax portal. Companies must register on the portal and upload the required forms and supporting documents. Late or incorrect filings can trigger administrative fines. For instance, late CIT or VAT filings may incur fines from 2–25 million VND (higher for repeats) plus daily interest of 0.03% on unpaid tax. Common deadlines are synchronized: tax payments must accompany returns, and returns for each tax are due on the deadlines above unless an extension is granted.

Access the 2025 Tax & HR Calendar for crucial deadlines and ensure your business stays compliant in Vietnam.

Incentives and Deductions for SMEs

Vietnam’s tax code provides targeted incentives to reduce burdens on SMEs. Aside from the tiered CIT rates (15% and 17% for small firms), SMEs benefit from extended deductions and holidays. Converting from a household enterprise to a company triggers a 2-year CIT holiday. Businesses undertaking approved R&D, technology upgrades or green projects can deduct related expenses beyond normal limits, and certain innovation grant income is non-taxable. SMEs in deprived or economic zone areas may qualify for preferential tax rates or holidays under investment incentive rules (for example, temporary 10% CIT for up to 15 years).

VAT incentives include the temporary 8% rate and exemptions for agricultural inputs. SMEs exporting goods often receive VAT refunds. In the personal tax regime, rising income allowances (11 million/month personal relief, 4.4m/dependent) and the 200-million-VND exemption for very small household businesses ease PIT for micro-entrepreneurs. SMEs should also note common deductible expenses: employee salaries, training, and government-approved contributions generally lower taxable income. Donations to certain charity or policy funds (up to 10% of revenue) are deductible under Viet Nam’s CIT law. Companies can leverage accelerated depreciation for machinery and import tools used in manufacturing, although only under government-approved lists.

Penalties for Non-Compliance

Vietnam’s tax authorities enforce strict penalties for non-compliance. Even innocent delays accumulate costs: late tax payment incurs interest at 0.03% per day (about 10% annualized). Late filings incur fines: for example, missing a deadline can mean fines of 2–25 million VND, depending on how late and whether it’s a repeat offense. The tax law caps administrative fines at 200 million VND for companies (100 million for individuals) per violation.

More serious is misreporting or evasion. Understating income or falsifying documents can trigger fines of 20–30% (or higher) of the evaded tax, plus interest. In blatant cases, penalties may reach 1–3 times the underpaid tax, and criminal prosecution is possible for large-scale evasion. Vietnam also penalizes improper invoicing – use of fake invoices can be fined 20–50 million VND, and failure to withhold (for example, on foreign contractor payments) makes the payer liable for the full tax due plus penalties. Underpayments discovered in audits will yield both interest and fines. In short, SMEs should treat compliance seriously: maintaining proper books, meeting e-invoice rules, and filing on time avoids steep penalties.

How Can InCorp Help?

At InCorp Vietnam, we act as your compliance partner to help prevent costly tax penalties. We provide end-to-end tax compliance and advisory services: from setting up your e-invoice system, managing accurate bookkeeping, preparing and reviewing filings (VAT, CIT, PIT, FCT), applying extensions when eligible, to handling disputes with tax authorities. We constantly monitor legal changes, apply the latest regulations in your filings, and double-check your documents to catch discrepancies before submission. With our support, you can reduce your exposure to tax penalties, focus on growing your business, and operate with confidence under Vietnam’s evolving tax regime.

Conclusion

Vietnam’s tax system for SMEs is comprehensive and evolving, with recent reforms aimed at supporting small businesses. SMEs benefit from lower CIT rates, exemptions on business license tax, higher VAT/PIT thresholds, and targeted incentives. However, they must navigate multiple taxes and strict compliance requirements. Key deadlines (monthly VAT/PIT withholdings, quarterly CIT payments, and annual finalizations) must be tracked closely. Diligent record-keeping, use of the eTax portal, and awareness of deductions (for R&D, training, etc.) can optimize an SME’s tax position. Ultimately, understanding Vietnam’s tax system – from CIT and VAT to personal taxes and penalties – is essential for SMEs to remain compliant and take full advantage of available incentives.

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

How does Vietnam’s tax system give SMEs an advantage over larger firms?

- SMEs enjoy lower CIT rates (15–17%), business license tax exemptions in the first year, and simplified VAT/PIT thresholds. These measures reduce costs and encourage small businesses to formalize and grow.

What is the biggest compliance risk for SMEs in the tax system?

- The most common issue is missing deadlines for VAT, PIT, or quarterly CIT payments. Even small delays incur daily interest (0.03%) and fines, while repeated violations can trigger audits and loss of incentives.

How can SMEs legally reduce their tax burden?

- SMEs can leverage deductions (salaries, training, R&D, employee benefits), apply for VAT refunds on exports, and take advantage of location-based incentives in high-tech parks or disadvantaged zones. Smart tax planning turns compliance into savings.

What are the long-term consequences of poor <a href="https://vietnam.incorp.asia/guide-to-bookkeeping-for-tax-compliance/" data-wpil-monitor-id="17">tax compliance</a>?

- Beyond fines, non-compliance damages credibility with banks, investors, and partners. SMEs risk losing access to incentives and may face stricter scrutiny from authorities—hurting growth prospects in the long run.