Vietnam, as we near the end of 2023, emerges as a shining example of growth and opportunity in the international economic arena. Highlights of Vietnam’s economic ascent are evident in its distinction within the ASEAN region, particularly in the high-tech manufacturing sector, underlining the nation as an investment hub.

This article delves into the nuances of Vietnam’s economic growth, with a spotlight on the country’s robust global trade ties and progressive economic policies. It serves as a guide for foreign investors to explore Vietnam’s remarkable development trajectory, emphasizing strategic innovation and effective planning that have significantly raised the country’s investment allure.

Investing in Vietnam? Check out InCorp Vietnam’s Incorporation Services

Vietnam’s FDI Performance Highlights in 2023

In 2023, Vietnam’s economy, though growing slower than expected at 5.05%, remained a regional leader in growth, fueled by increasing corporate confidence. This rate, reported by the General Statistics Office, fell short of the 6-6.5% target set by the National Assembly. Despite this, the economy demonstrated resilience, recovering steadily over the year, especially in the agro-forestry-fishery, industry, construction, and service sectors.

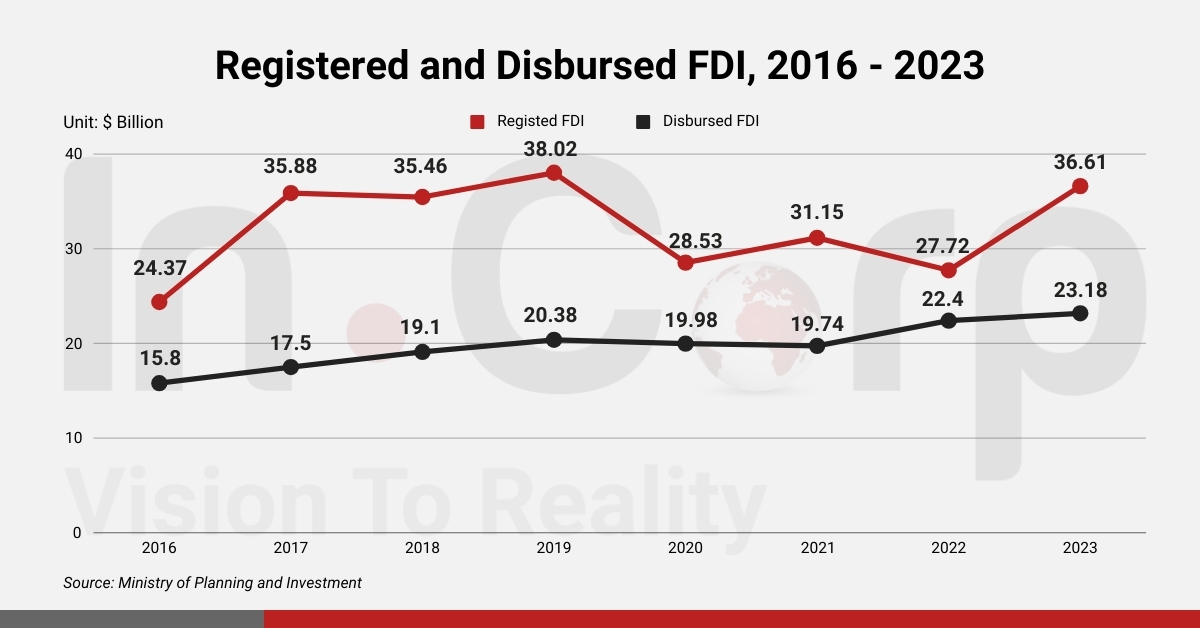

However, Vietnam’s foreign direct investment (FDI) witnessed a strong finish in 2023, despite a sluggish start. By December 20, the Ministry of Planning and Investment reported US$36.61 billion in FDI, a 32.1% increase over the previous year. This growth is highlighted by a record US$23.18 billion in realized FDI, up by 3.5% year-on-year. The year saw a 62% jump in newly registered capital at US$20.2 billion and a 56.6% increase in new projects, totaling 3,188.

Capital contributions and share purchases also saw a notable rise of 65.7% to US$8.5 billion. Key manufacturing hubs emerged in Nghe An, Hai Duong, and Thai Binh, attracting over US$1 billion each in 2023. Overall, by year’s end, Vietnam accumulated 39,140 FDI projects with over US$468.91 billion in registered capital. Ho Chi Minh City led FDI attraction with US$57.63 billion across 12,398 projects, followed by Hanoi and Binh Duong province.

Read More: Vietnam’s FDI – Analysis of Industries, Source Countries, and Geographical Regions

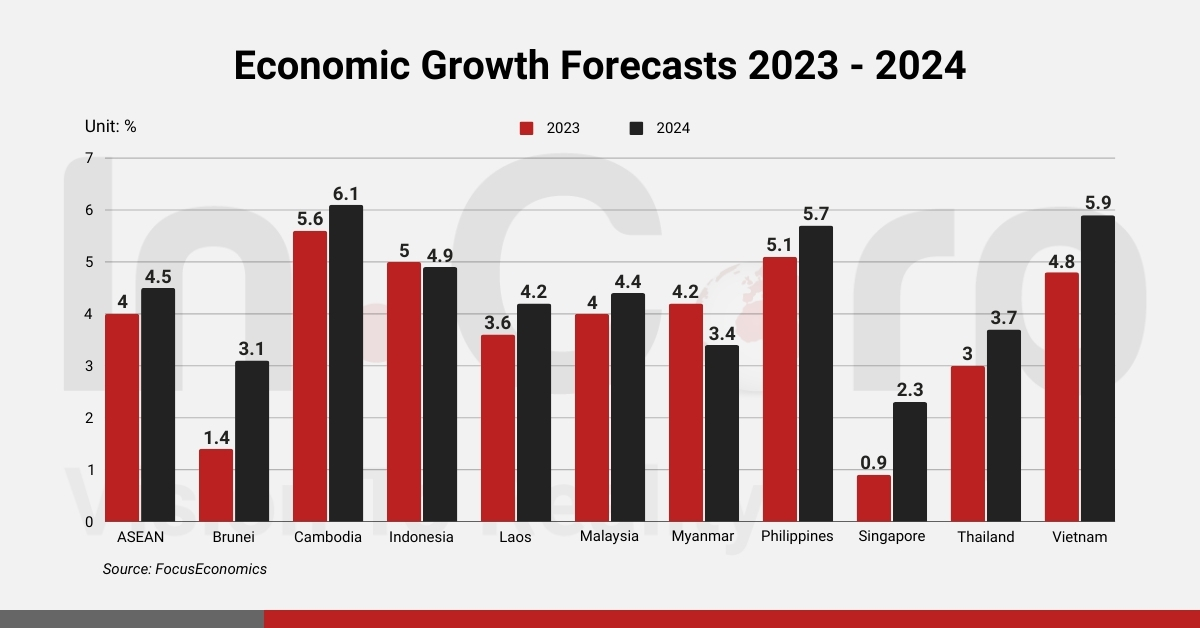

The IMF acknowledges Vietnam’s strong performance relative to other ASEAN countries and globally. In 2024, Vietnam is expected to continue surpassing the ASEAN average, driven by rising exports and investment growth. Analysts predict Vietnam to be among the fastest-growing ASEAN economies in 2024, potentially benefiting from increased external demand and public spending.

Vietnam’s US$7 Billion Burgeoning Pharmaceutical Market

Vietnam’s pharmaceutical market, valued between US$6-7 billion in 2022, is largely driven by prescription drugs, contributing over 70% of the industry’s revenue. The retail pharmacy sector, featuring nearly 60,000 outlets, is valued at around US$2 billion. Modern chain stores, though a small fraction of the total, play a significant role. Key growth drivers include an aging population, increased health awareness post-pandemic, and the need for health supplements due to high air pollution levels.

Foreign investment interest is strong, highlighted by Dongwha Pharm Group’s US$30 million acquisition of Trung Son Pharma. In the competitive retail landscape, Pharmacity and Long Chau are prominent players. Long Chau, managed by FPT Retail, has overtaken Pharmacity in store count, expanding to nearly 1,600 stores with impressive growth. This rapid expansion and market dominance underscore Vietnam’s pharmaceutical sector’s dynamic nature and potential, attracting domestic and international investors.

Read More: Ease of Doing Business in Vietnam’s Pharmaceutical Market for Foreign Investors

JICA Secures US$290M for Ben Thanh-Suoi Tien Rail

The Japan International Cooperation Agency (JICA) has signed a loan agreement with the Vietnamese government to provide a US$290 million ODA loan for Line 1 of the Ho Chi Minh City Urban Railway project. This project, set for completion in 2024, aims to alleviate traffic congestion and air pollution in Ho Chi Minh City, while also promoting regional economic development. It aligns with the United Nations’ Sustainable Development Goals, focusing on industry, innovation, infrastructure, sustainable cities, communities, and climate action.

The loan for the Ben Thanh-Suoi Tien section will utilize Japanese technology, including underground civil engineering, rolling stock, and communication systems, under the Special Terms for Economic Partnership (STEP). The Ben Thanh-Suoi Tien section, part of Ho Chi Minh City’s planned mass public transport system, has a total investment of over US$1.82 billion and spans nearly 20km. This first urban railway project in the city, which began construction in 2012, is nearing completion with test runs underway and an operational goal set for July 2024.

Read Related: Fundamentals of Japan & Vietnam’s Trade Under the VJEPA

THACO Group’s US$4.2B Investment in Circular Economy

THACO Group is advancing its US$4.2 billion THACO Circular Economy Complex in Lam Dong province, focusing on a fully circular economy chain from bauxite mining to ecotourism. The project, including the Lam Dong 2 Alumina Plant with a 4 million tonne annual capacity, aims for completion beyond 2024.

With a 50-year operational horizon, this ambitious initiative plans to integrate additional developments like red mud material production and high-tech agriculture. Expected to generate a 16.2% annual return and create 4,000 jobs, the project will significantly contribute to the state budget and regional development.

Read More: Setting a Plant in Vietnam’s Industrial Zones – A Key Player in Global Manufacturing

Apple Suppliers Invest Billions to Diversify from China

Apple suppliers are diversifying their manufacturing bases from China, driven by production delays, COVID-19 measures, energy supply issues, and US trade tensions. This shift has impacted Apple’s revenues by over US$30 billion since the pandemic’s start. Apple and its 188 key suppliers are accelerating relocation plans, investing around US$16 billion since 2018 to move production to India, Mexico, the US, and Vietnam.

The relocation involves higher short-term costs but promises long-term benefits once ex-China capacities scale up. Establishing a new manufacturing plant can take up to 18 months, with longer times for organizing the entire supply chain. India is emerging as a significant iPhone production hub. Vietnam is becoming a major center for Mac and iPad manufacturing, already supporting about 40% of the annual US demand for these products.

Read Related: Moving to Vietnam for Chinese Businesses: What are the Benefits?

South Korea opens US$14M Logistics Center in Dong Nai

South Korea’s Ministry of Oceans and Fisheries has established a corporate entity to open a US$14.3 million logistics center in Dong Nai, Vietnam. The K-UPA center, developed in collaboration with the Ulsan Port Authority and South Korean logistics firm KCTC, is designed to support South Korean small- and medium-sized enterprises (SMEs) by providing storage facilities for goods at room or low temperatures.

The facility, covering 12,000 square meters with a storage capacity of 4.3 million pallets, will be 80% owned by the Ulsan Port Authority and 20% by KCTC’s Vietnamese subsidiary. Slated for preliminary operation in December 2024 and full service by July 2025, the center aims to enhance the export competitiveness of South Korean firms in Southeast Asia, offering discounts of 10-15% to South Korean SMEs. KCTC Vietnam, established in 2008, is a leading third-party logistics company in the country.

Read Related: A Look into Business Opportunities in the Logistics Industry in Vietnam

Ecolab Launches New Manufacturing Plant in Vietnam

Ecolab, a U.S.-based company specializing in water, hygiene, and infection prevention solutions, has opened a new manufacturing plant in Ho Nai Industrial Park, Dong Nai. Spanning 3,000 square meters, the facility includes an advanced laboratory, manufacturing area, and warehouse, and will increase Ecolab’s workforce in Vietnam to over 100 employees.

The plant reflects Ecolab’s commitment to sustainability and will support various industrial markets, including food services and healthcare. It aims to optimize water and energy use, contributing to Vietnam’s economic growth and regional sustainability. The opening signifies Ecolab’s strategic focus on Vietnam, enhancing local customer support and innovation capabilities in Southeast Asia.

Read More: Updates on US Investments in Vietnam – A Surprisingly Fruitful Partnership

Dong Nai Approves US$156M in Foreign Projects

On January 8, the Dong Nai People’s Committee issued investment certificates for four foreign-invested projects worth over US$156 million. The largest investment of US$121.4 million comes from Singapore’s Sea Fund I Investment 14 Pte. Ltd. for the SLP Park Loc An Binh Son, focusing on warehousing and logistics. Freudenberg & Vilene International Vietnam from Hong Kong is investing US$10 million in a cotton wool and sheets manufacturing facility. South Korea’s KCTC Vina Co., Ltd. will allocate US$10 million for the K-Upa Vina goods storage services project, while Ryder Industries Vietnam Co., Ltd. is establishing a US$15-million electronic components manufacturing plant.

In addition, Dong Nai awarded certificates to four expansion projects totaling US$217 million. Nestlé Vietnam is investing an additional US$100 million in its Tri An factory, raising its total investment to US$502 million for sustainable coffee production. Kenda Rubber is expanding its tire factory with a US$80 million investment. Hyosung Dong Nai Co., Ltd. and Advanced Multitech (Vietnam) LLC increased their investments by US$19 million and US$18 million, respectively, in their respective sectors. These projects reflect Dong Nai‘s focus on attracting significant investments in logistics, high-tech, supporting industries, and IP infrastructure development.

Read Related: Choosing the Ideal Business Location in Vietnam – The First Step of Success

Nghe An Attracts US$311M in Foreign Projects

Nghe An province has awarded investment certificates to six new projects in the Southeast Nghe An Economic Zone, totaling US$390 million. This includes five foreign-invested projects valued at US$311 million. Key investments come from Taiwan’s Radiant Opto-Electronics Corporation and Hong Kong’s Everwin Precision Technology Vietnam Co., Ltd., focusing on electronic components and auto parts manufacturing.

Other notable foreign investments include Singapore’s Luxcase Precision Technology’s US$24 million factory and projects by China’s Fujian Xinfeng Technology and Gaojia Optoelectronic Technology. Additionally, the local Hoang Thinh Dat Corporation received approval for the Hoang Mai II Industrial Park, a US$77.54 million project. In 2023, Nghe An attracted over US$1.6 billion in FDI, marking a 66.8% increase and elevating the province to 8th place nationally in FDI attraction.

We made the most detailed step-by-step guide for Company Incorporation in Vietnam for investors, now available as an interactive checklist:

About Us

InCorp Vietnam is a leading market entry and corporate services firm in Vietnam. We are part of InCorp Group, a regional leader in corporate solutions that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,200 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business fit into the market perfectly with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.